Forex Trading Course

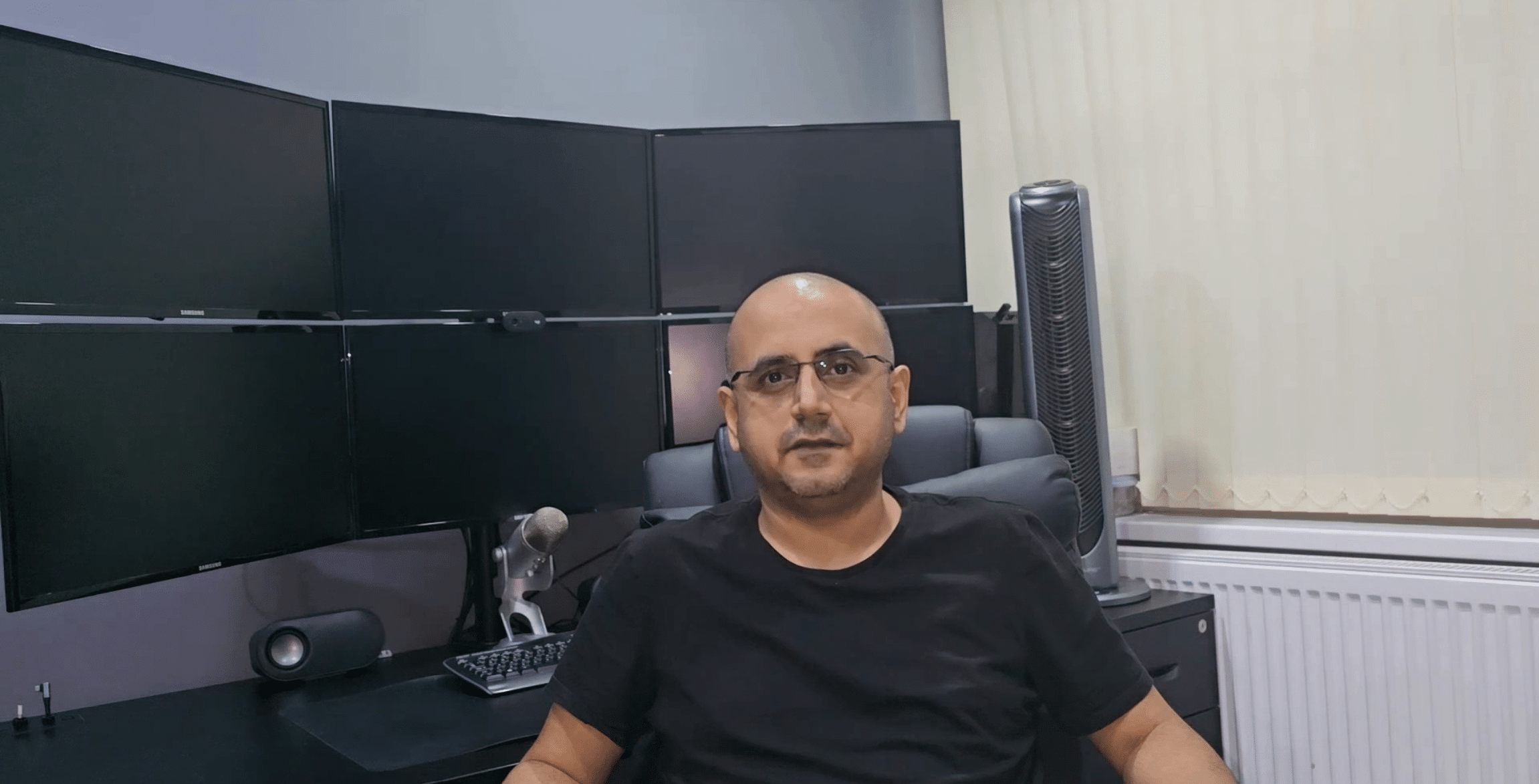

The Forex Trading Masterclass is a comprehensive, CPD-certified forex trading course created and presented by Sachin Kotecha. It is designed as a structured educational programme that develops a professional understanding of how the global currency markets operate. The 24-module curriculum progresses from market foundations through to risk management, psychology, and strategy frameworks, with a clear emphasis on analytical process, structure, and disciplined decision-making.

About This CPD-Certified Forex Trading Course

Across 24 professionally structured modules, this programme provides a complete educational overview of professional forex market analysis. The course focuses on developing structured reasoning, market understanding, and risk-aware thinking rather than signals, recommendations, or performance-based outcomes.

What You’ll Learn

Market Foundations – Understand forex market structure, participants, trading sessions, currency pricing, and order mechanics.

Fundamental Analysis – Explore the macroeconomic forces influencing currencies, including interest rates, inflation, growth data, employment trends, trade balances, and central bank policy, with guidance on interpreting economic releases in context.

Technical Analysis – Learn how charts are used to analyse price behaviour, including trends, support and resistance, indicators such as RSI and MACD, candlestick analysis, and multi-timeframe evaluation.

Psychology and Discipline – Examine behavioural influences on trading decisions, emotional control, bias awareness, and the role of discipline in maintaining analytical consistency.

Risk and Money Management – Study position sizing principles, stop placement, drawdown awareness, volatility considerations, and capital protection frameworks.

Strategy Frameworks – Learn how trading approaches are structured, reviewed, and refined, including an overview of different trading styles and systematic thinking.

Professional Development – Concluding modules focus on trade management concepts, diversification principles, and continuous improvement within a personal analytical framework.

How This Forex Trading Course Is Delivered

All modules are delivered through recorded video lectures presented by Sachin Kotecha, combining structured slide content with detailed explanations. Learners may complete an end-of-course assessment and, upon successful completion, receive a CPD-accredited certificate.

Who This Course Is For

This course is suitable for individuals seeking a structured introduction to forex markets as well as those aiming to formalise and professionalise an existing analytical approach through education.

Skills and Understanding You’ll Develop

- A structured understanding of how the forex market operates.

- The ability to analyse currencies using macroeconomic and technical frameworks.

- Risk-aware thinking and capital management principles.

- A repeatable analytical process for ongoing development.

- Greater discipline and consistency in market evaluation.

Why Choose This Forex Trading Course

This programme provides a structured educational pathway for understanding professional forex market analysis. It integrates market foundations, macroeconomic context, technical frameworks, psychology, and risk management into a single cohesive learning experience aligned with recognised CPD standards.

Frequently Asked Questions

Is this a beginner-friendly forex trading course?

Yes. The course begins with foundational concepts and progresses methodically to more advanced analytical and risk frameworks.

Is the course CPD-certified?

Yes. Successful completion qualifies for a CPD-accredited certificate issued via the CPD Certification Service.

How is the content delivered?

The programme is delivered through recorded video lectures supported by structured slides and explanations.

What is the duration of the course?

The course consists of 24 modules, each designed as an approximately one-hour lecture, and is fully self-paced.

Does the course cover both technical and fundamental analysis?

Yes. The curriculum includes market structure, macro fundamentals, technical analysis, psychology, risk management, and professional development concepts.

Curriculum

- 27 Sections

- 26 Lectures

- 6 Weeks

- Introduction To The Forex Trading MasterclassThis introduction sets the strategic foundation for the Forex Trading Masterclass, framing how global economic forces, capital flows, and policy decisions drive continuous movement in currency markets. It clarifies the role of professional forex analysis, introduces core macroeconomic themes such as growth, inflation, interest rates, and central bank policy, and reorients thinking beyond charts—positioning forex as a dynamic reflection of confidence, risk, and global interconnectedness rather than isolated price action.1

- Module 1 - Introduction To Forex MarketsThis module introduces the structure of the global forex market, explaining how it operates as the largest and most liquid financial marketplace in the world. You’ll learn who the key participants are and how the 24-hour trading cycle creates unique opportunities for traders.1

- Module 2 - Currency Pairs & Market MechanicsGain a clear understanding of how currencies are quoted and traded in pairs, with one as the base and the other as the quote. You’ll explore the concepts of pips, spreads, and leverage, which form the foundation of forex trading mechanics.1

- Module 3 - Forex Quotes & Order TypesLearn how to read bid/ask quotes and the difference between common order types such as market, limit, and stop orders. This module also covers margin essentials, ensuring you understand the risks and requirements of leveraged trading.1

- Module 4 - Key Macro Drivers of ForexExamine the major economic factors that drive currency values, from interest rate policy and inflation trends to GDP growth and central bank actions. This knowledge will help you anticipate market moves and align your trades with fundamental drivers.1

- Module 5 - Economic Indicators OverviewDiscover the role of key economic indicators, including employment data, consumer price inflation, PMI surveys, and trade balance figures. You’ll learn how traders interpret these releases and why they often trigger volatility in the forex market.1

- Module 6 - Trading Psychology FundamentalsExplore the critical role of mindset in trading and learn how to manage emotions, avoid biases, and build discipline. This module sets the foundation for developing resilience and a professional approach to trading challenges.1

- Module 7 - Risk Management EssentialsUnderstand how to protect your capital by applying risk management principles such as position sizing, stop losses, and risk/reward ratios. You’ll also learn how to handle drawdowns and safeguard long-term profitability.1

- Module 8 - Building A Trading PlanThis module guides you through creating a structured trading plan, complete with defined goals, rules, and performance tracking. You’ll also learn the value of journaling and routine in building consistency.1

- Module 9 - Technical Analysis BasicsGet introduced to the foundations of technical analysis, including chart types, trend identification, and support and resistance levels. These tools will help you read market behaviour and plan trades more effectively.1

- Module 10 - Key Technical IndicatorsDiscover how to use moving averages, RSI, and MACD to analyse price momentum, identify reversals, and confirm signals. You’ll see how technical indicators can enhance decision-making when combined with price action.1

- Module 11 - Price Action & Candlestick PatternsLearn how candlestick formations reveal trader psychology and market sentiment. This module covers common patterns and teaches you how to spot signals for trend continuation and reversal.1

- Module 12 - Entry & Exit StrategiesMaster the art of timing trade entries and exits, using confirmation tools to improve execution. You’ll gain confidence in setting clear rules for when to enter, scale, or close trades.1

- Module 13 - Trading Styles & TimeframesCompare different trading styles, from fast-paced scalping to longer-term position trading, and learn which suits your goals and personality. You’ll also explore how timeframes affect analysis and strategy.1

- Module 14 - Advanced Chart PatternsDelve into complex chart formations like triangles, flags, and head-and-shoulders. This module shows how these patterns can signal breakouts, reversals, and key opportunities.1

- Module 15 - Using Economic Calendars & NewsLearn how to interpret economic calendars and prepare for news-driven volatility. You’ll understand how to assess event risk and incorporate market-moving releases into your trading strategy.1

- Module 16 - Market Sentiment AnalysisThis module explains how to measure trader sentiment using tools like the Commitment of Traders (COT) report, retail positioning data, and sentiment indicators. By understanding market mood, you’ll add another dimension to your analysis.1

- Module 17 - Trade Management TechniquesGo beyond entries and exits to master managing trades in progress. You’ll explore scaling into positions, using trailing stops, and taking partial profits to maximise efficiency.1

- Module 18 - Currency Correlations & Portfolio DiversificationLearn how different currency pairs move in relation to each other and how correlations can increase or reduce risk. You’ll also explore diversification and basic hedging to protect your portfolio.1

- Module 19 - Advanced Risk ControlsStrengthen your trading with advanced methods such as volatility-based stops, maximum drawdown rules, and scenario planning. These tools help you navigate uncertainty and maintain discipline under pressure.1

- Module 20 - Common Trading Mistakes to AvoidIdentify the pitfalls that hold traders back, from overtrading and revenge trading to lack of discipline. By recognising these errors, you’ll learn how to sidestep them and stay consistent.1

- Module 21 - Backtesting & Strategy RefinementDiscover how to backtest trading strategies using historical data and record results effectively. This process will teach you how to refine and improve strategies for long-term success.1

- Module 22 - Algorithmic & Automated TradingExplore the growing field of algorithmic trading and automation, including how systems work, their advantages, and limitations. This module provides a practical introduction to using technology in your trading.1

- Module 23 – Advanced Trade PsychologyDeepen your psychological edge with advanced techniques to manage stress, overcome biases, and maintain focus. This module equips you with the tools to trade consistently in challenging conditions.1

- Module 24 - Developing A Personal Trading EdgeBring everything together to design and refine your own unique trading edge. You’ll combine market analysis, risk control, and adaptive learning to achieve consistent, long-term results.1

- Forex Trading Masterclass ExamThe Exam tests your knowledge across all 24 modules of the Masterclass, covering market foundations, analysis, psychology, and risk management. Timed at 60 minutes with unlimited retakes, it’s the final step to consolidate your learning and unlock your CPD certificate.1

- FeedbackShare your learning experience and let us know how the Masterclass has supported your trading journey. Your feedback helps us improve and guides future students in understanding the value of the course.1