Trade Idea Generation Course

Develop a structured, professional approach to forming and evaluating market hypotheses with this comprehensive Trade Idea Generation Course. Designed as an educational programme, the course examines how macroeconomic context, market structure, sentiment indicators, liquidity conditions, and technical analysis are combined within professional analytical workflows. The focus is on building disciplined reasoning, contextual understanding, and repeatable analysis processes rather than trade signals, probability claims, or execution outcomes.

About This Trade Idea Generation Course

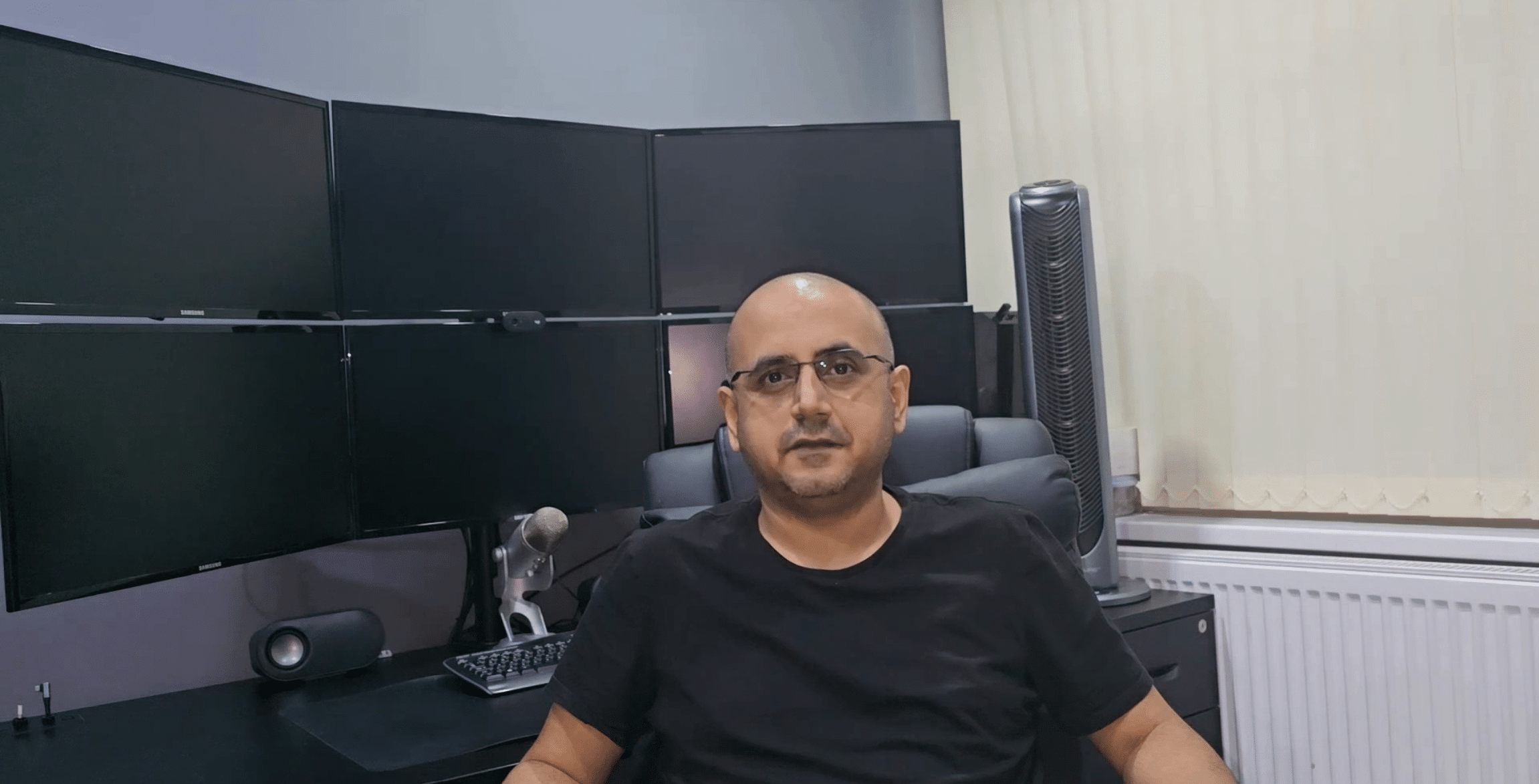

Across 24 professionally structured modules, this programme — created and presented by Sachin Kotecha — provides a structured educational framework for analysing markets and developing well-reasoned trade hypotheses. Learners are guided through a top-down analytical process covering macro regimes, thematic drivers, sentiment context, volatility conditions, liquidity considerations, and scenario construction. The programme is educational in nature and focuses on analytical structure and decision discipline rather than trade instruction or execution.

Why Trade Idea Generation Matters

Effective market analysis depends on the ability to organise information, assess context, and form structured views rather than reacting to isolated indicators. Trade idea generation, when approached as an analytical discipline, helps learners understand how different market inputs interact and how narratives evolve over time. This Trade Idea Generation Course explains how macro drivers, policy developments, sentiment conditions, intermarket relationships, and price behaviour are commonly interpreted within professional analytical frameworks.

What You’ll Learn in This Course

Across 24 structured modules, you’ll develop a repeatable analytical process for forming and evaluating market ideas:

- Interpret macroeconomic regimes, policy cycles, and economic narratives within a broader market context.

- Identify and assess thematic drivers, sentiment conditions, and positioning indicators as analytical inputs.

- Examine cross-market relationships and multi-asset context to support market understanding.

- Incorporate volatility, liquidity, and risk conditions into structured scenario analysis.

- Use technical structure and market behaviour to contextualise timing considerations within analysis.

- Construct and review market hypotheses grounded in evidence, logic, and structured reasoning.

By the end of this Trade Idea Generation Course, you’ll be able to apply a disciplined framework for analysing markets and developing well-supported market views within your own independent analytical process.

Who This Course Is For

This course is suitable for individuals seeking a more structured and professional approach to market analysis. It is designed for retail market participants developing analytical discipline, macro-focused investors refining their market interpretation skills, and financial professionals looking to formalise their analytical workflow. No prior macroeconomic or quantitative background is required.

What Makes This Course Unique

Rather than teaching specific strategies or trade rules, this Trade Idea Generation Course focuses on how professional analysts structure thinking and evaluate information. Learners explore historical market regimes, policy cycles, and behavioural dynamics to understand how market narratives develop. The emphasis is on building a repeatable, independent decision-making framework grounded in analysis rather than prediction or outcome-led thinking.

Analytical and Professional Development Outcomes

By completing the Trade Idea Generation Course, learners will strengthen their ability to interpret macroeconomic developments, sentiment context, liquidity conditions, and cross-asset relationships. The objective is to improve analytical structure, preparation quality, and consistency in market evaluation, supporting a more disciplined and professional approach to ongoing market analysis.

Enrol Today

If you are looking to develop a more structured framework for analysing markets and forming well-reasoned trade ideas, you can enrol in the Trade Idea Generation Course and complete the programme at your own pace through the online platform.

FAQs

How long does it take to complete the Trade Idea Generation Course?

The course includes 24 modules of approximately 15–20 minutes each and can be completed at your own pace over four to six weeks.

Is this course suitable for beginners?

Yes. The course starts with foundational analytical concepts and progresses to more advanced market-interpretation frameworks, making it suitable for a wide range of experience levels.

Does the course include mentoring or live sessions?

This is a fully self-paced masterclass delivered through recorded video lectures with structured exercises and a final assessment.

Will I receive a certificate?

Yes. You’ll receive a digital certificate of completion upon successfully finishing the programme.

What materials are included?

You’ll have access to video lectures, downloadable reference materials, and a final assessment designed to reinforce the analytical frameworks covered in the course.

Curriculum

- 27 Sections

- 26 Lectures

- 6 Weeks

- Introduction to the Trade Idea Generation MasterclassA concise overview of the programme’s purpose, showing how this masterclass reshapes your approach to markets by teaching a structured, professional, and evidence-based workflow for generating high-conviction trade ideas.1

- Module 1 – Introduction to Professional Trade Idea GenerationA clear overview of how professional traders conceptualise, structure, and execute high-quality trade ideas, introducing the workflow, mindset, and analytical discipline required to operate at an institutional standard.1

- Module 2 – Market Regimes, Macro Landscapes & Context SettingAn exploration of how different macro regimes shape opportunity sets, influence price behaviour, and determine which types of trade ideas are most likely to succeed in shifting economic environments.1

- Module 3 – Understanding Narrative, Catalysts & Market DriversA breakdown of how narratives, catalysts, and market drivers evolve, how they influence sentiment and positioning, and how traders can use them to anticipate potential shifts and emerging opportunities.1

- Module 4 – Building a Robust Top-Down FrameworkA detailed guide to constructing a structured top-down process that filters noise, clarifies directional bias, and helps you consistently identify high-probability themes across markets and time horizons.1

- Module 5 – Fundamentals: Macro, Micro & Cross-Asset FiltersAn in-depth look at the fundamental filters professionals use to assess validity, including macro data, micro drivers, and cross-asset dynamics that help refine and validate early trade ideas.1

- Module 6 – Sentiment, Positioning & Behavioural FlowsA deeper examination of how sentiment indicators, positioning extremes, and behavioural patterns shape short-term price action, offering insight into when markets may be vulnerable to reversals or continuations.1

- Module 7 – Volatility, Liquidity & Market ConditionsAn assessment of how volatility regimes, liquidity cycles, and market conditions determine the quality of trade ideas, influence risk parameters, and impact execution precision.1

- Module 8 – Relative Value Thinking & Comparative AnalysisA practical introduction to relative value logic and comparative analysis, teaching you how to evaluate assets against one another to identify strength, weakness, and asymmetric opportunities.1

- Module 9 – Multi-Asset Inputs & Intermarket ConfirmationA comprehensive view of how cross-asset markets provide confirmation or conflict signals, helping you strengthen or challenge your trade ideas through a broader macro lens.1

- Module 10 – Price Structure, Technical Triggers & Timing ConceptsA detailed breakdown of how price structure, technical signals, and timing frameworks can be integrated to refine entry, stop placement, and trade execution with greater precision.1

- Module 11 – Constructing a Trade HypothesisA complete walkthrough on how to develop a clear, structured trade hypothesis, defining bias, catalysts, scenario expectations, and the logical path from idea to execution.1

- Module 12 – Validating a Trade Idea With EvidenceA rigorous approach to evidence-based validation, showing how data, price behaviour, cross-asset alignment, and fundamental trends confirm or invalidate your developing thesis.1

- Module 13 – Risk/Reward Logic & Asymmetric OpportunityAn exploration of how to assess risk/reward structure, identify asymmetric setups, and filter out ideas that lack the necessary skew or structural advantage for professional-grade trading.1

- Module 14 – Confidence, Probability & Scenario PlanningA structured approach to building conviction, weighting probabilities, and planning multiple scenarios that enable you to stay adaptive as markets evolve.1

- Module 15 – Macro + Technical Confluence ModelsAn examination of how macro reasoning, technical structure, sentiment conditions, and volatility regimes intersect to create powerful confluence-based trade ideas.1

- Module 16 – Event-Driven Idea GenerationA guide to generating high-quality trade ideas around major events—such as central-bank decisions, CPI prints, NFP releases, earnings, and geopolitical developments—while managing risk intelligently.1

- Module 17 – The Playbook: Pattern Recognition & High-Probability SetupsAn introduction to the repeatable playbook frameworks and market patterns used by professionals to identify, categorise, and exploit recurring high-probability opportunities.1

- Module 18 – Market Inefficiencies, Mispricings & Edge DiscoveryA deeper look into how to uncover mispricings, structural distortions, and inefficiencies across markets, and how these anomalies can form the foundation of compelling trade ideas.1

- Module 19 – Trade Idea Execution FrameworksA professional breakdown of execution methodologies, microstructure considerations, order-type selection, and optimal execution principles that influence the success of a trade idea.1

- Module 20 – Journaling, Review & Continuous ImprovementA practical framework for tracking, analysing, and improving your idea-generation process through structured journaling, post-trade review, and deliberate refinement.1

- Module 21 – Building a Professional-Grade WatchlistA detailed explanation of how to design and maintain a dynamic watchlist that continually surfaces high-quality trade opportunities with clarity and purpose.1

- Module 22 – Synthesising Multiple Inputs Into a Cohesive Trade ThesisA complete guide on how to merge macro, sentiment, technicals, and market structure into a unified, well-supported trade thesis with clear logic and execution parameters.1

- Module 23 – Advanced Institutional-Style Idea Generation TechniquesAn advanced set of frameworks, workflows, and analytical techniques used by hedge funds and institutional desks to uncover deeper, more sophisticated trade ideas.1

- Module 24 – Final Integration & The Professional Trade Idea BlueprintA closing synthesis that brings every concept together into one cohesive, repeatable, professional-grade idea-generation blueprint for real-world application.1

- Trade Idea Generation Masterclass ExamThe Exam tests your knowledge across all 24 modules of the Trade Idea Generation Masterclass, covering macro context, narrative analysis, sentiment dynamics, technical triggers, and professional-grade trade construction. Timed at 60 minutes with unlimited retakes, it’s the final step to consolidate your learning and earn your personalised course completion certificate.1

- FeedbackShare your learning experience and let us know how the Masterclass has supported your trading journey. Your feedback helps us improve and guides future students in understanding the value of the course.1