Trader Protection Course

The Trader Protection Masterclass is a structured Trader Protection Course focused on helping traders recognise common risks, operational pitfalls, and information-quality issues that can undermine decision-making in financial markets. Across 24 modules, the programme develops practical risk awareness, verification habits, and process discipline, covering topics such as misinformation, behavioural traps, execution considerations, broker due diligence, and protective routines designed to support safer market participation.

About This Trader Protection Course

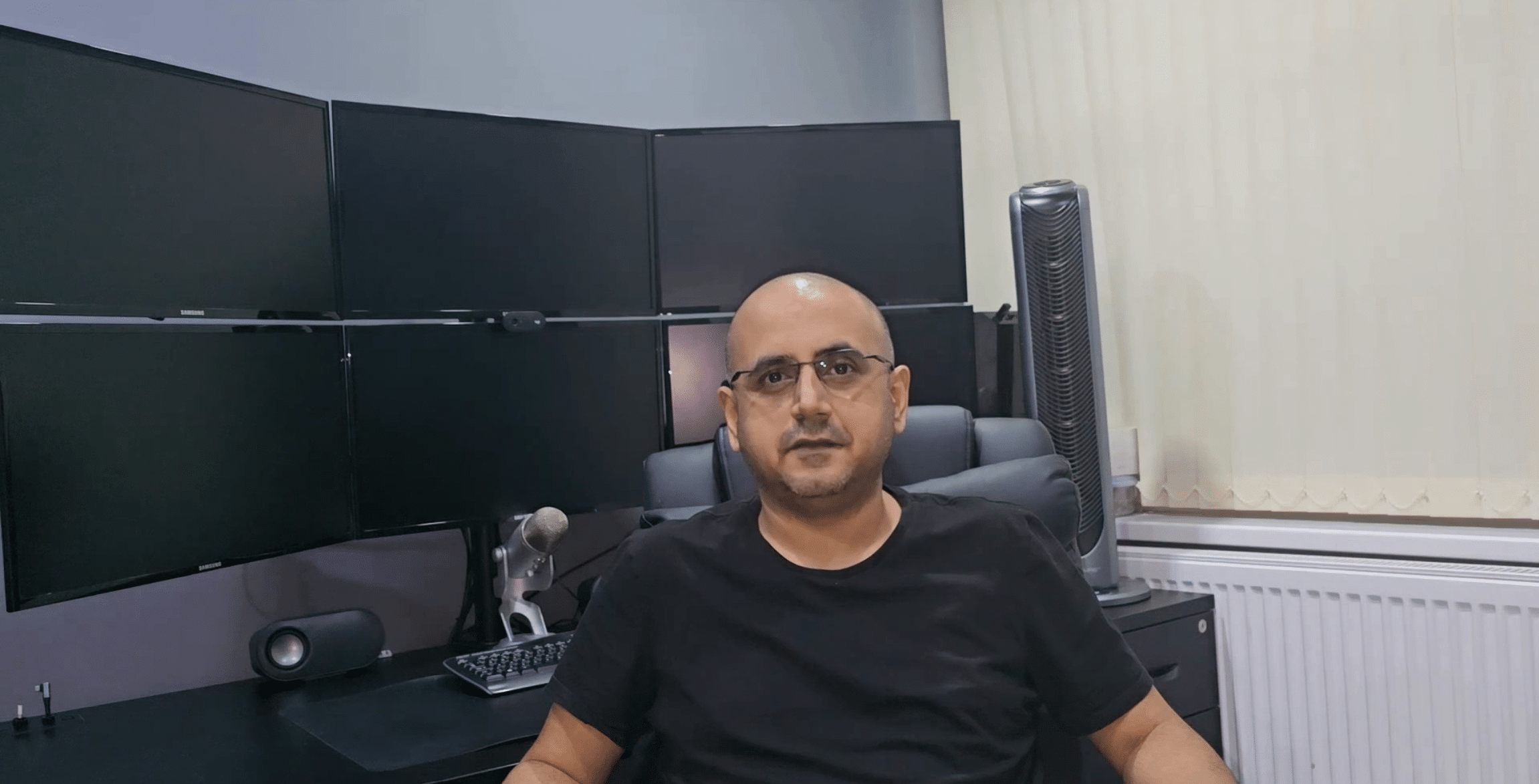

Spanning 24 structured modules, this programme — created and presented by Sachin Kotecha — provides an educational framework for trader protection, market integrity, and risk awareness. It explores how market structure, information asymmetry, behavioural bias, and operational mistakes can impact traders, and outlines practical methods for improving verification, reducing avoidable errors, and strengthening decision discipline.

What You’ll Learn

Market Integrity & Structural Risk – Understand market mechanics and structural features that can influence liquidity, volatility, and retail trading experience.

Manipulation Narratives & Behavioural Traps – Recognise common psychological patterns, social-media distortions, and decision traps that can lead to inconsistent execution.

Scam Awareness & Information Filtering – Learn practical approaches for identifying misleading claims, low-quality sources, and marketing tactics that target retail traders.

Broker Due Diligence & Execution Considerations – Understand key due-diligence checks, common execution models, and operational factors that can affect trade outcomes.

Risk, Leverage & Overtrading Control – Build routines and rules that support capital protection, defined exposure, and disciplined decision-making.

Operational Resilience – Plan for technical issues, platform interruptions, data errors, and process failures through checklists and contingency habits.

Ethics, Standards & Professional Conduct – Develop a professional mindset around verification, accountability, record-keeping, and decision hygiene.

Personal Trader Protection Framework – Create a repeatable protection system that supports safer behaviour, clearer thinking, and more robust process control.

How This Trader Protection Course Is Delivered

Each module is delivered through high-definition video lectures created and presented by Sachin Kotecha, using real-world examples and structured explanations. Learners can study at their own pace, revisit modules at any time, and build a practical protection framework that can be applied consistently within their own trading workflow.

Who This Course Is For

The Trader Protection Masterclass is designed for traders who want to strengthen risk awareness, verification habits, and operational discipline. It is suitable for beginners seeking a structured safety-first foundation and experienced traders aiming to reduce avoidable errors and improve process robustness.

Outcomes & Skills You’ll Gain

By completing this course, you’ll be able to:

- Improve your ability to evaluate information quality and recognise misleading claims.

- Apply broker due-diligence checks and understand key execution considerations.

- Reduce behavioural errors through structured routines and decision rules.

- Identify common operational risks and build practical contingency habits.

- Implement a personal protection framework designed to support safer, more consistent market participation.

Why Choose This Trader Protection Course

This programme is designed as a comprehensive trader-protection training pathway. It focuses on critical thinking, verification frameworks, operational discipline, and risk-aware routines that can help traders reduce avoidable mistakes and strengthen their overall process. If you’re looking for a Trader Protection Course that is structured, practical, and grounded in real-world trading behaviour, this masterclass provides a clear learning route.

Frequently Asked Questions

Is this Trader Protection Course suitable for beginners?

Yes. It starts with core risk foundations and builds progressively towards broader protection frameworks suitable for traders at all levels.

Is it a video-based course?

Yes. Every module is delivered through professionally recorded video lectures created and presented by Sachin Kotecha.

Who teaches this course?

The masterclass is created and presented by Sachin Kotecha.

How long does the course take?

It includes 24 modules, each around 20 minutes long, with full self-paced access.

Does it include real-market examples?

Yes. Concepts are illustrated using real-world scenarios and case examples to support practical understanding of trader protection topics.

Curriculum

- 27 Sections

- 26 Lectures

- 6 Weeks

- Introduction To The Trader Protection MasterclassThis module introduces the purpose and structure of the masterclass, outlining why trader protection is essential in modern markets and how a safety-first mindset supports long-term, professional trading performance.1

- Module 1 – Introduction to Trader Protection & Market IntegrityThis module introduces the core philosophy of trader protection, outlining why modern markets demand a disciplined, safety-first mindset. Students learn how integrity, transparency, and structural awareness form the foundation of sustainable trading performance.1

- Module 2 – How Financial Markets Actually WorkA clear, practical walkthrough of how markets function beneath the surface, explaining price formation, liquidity flows, and institutional behaviour so traders can navigate the system with confidence and realism.1

- Module 3 – Understanding Market ManipulationThis module explores common manipulation tactics, from stop-runs to spoofing, and teaches traders how to interpret irregular price behaviour and avoid being caught on the wrong side of engineered moves.1

- Module 4 – Retail Trading Traps & Behavioural PitfallsStudents examine the psychological and structural traps that retail traders regularly fall into, learning how cognitive biases and emotional decision-making undermine performance.1

- Module 5 – Influencer Culture & Misinformation RiskA deep dive into the risks of online financial misinformation, teaching traders how to separate credible insight from hype, persuasion tactics, and unqualified opinion.1

- Module 6 – Scam Awareness: Signals, Red Flags & PreventionThis module trains students to recognise the early warning signs of scams, fraud, and deceptive schemes, helping them build a proactive defence against financial exploitation.1

- Module 7 – Broker Due Diligence & Execution IntegrityStudents learn how to evaluate brokers professionally, examining execution, pricing, regulation, and operational practices to ensure safe and transparent trading environments.1

- Module 8 – Understanding Leverage, Margin & Liquidation RiskThis module builds a grounded understanding of leverage, margin mechanics, and liquidation events, helping traders manage position sizing with discipline and precision.1

- Module 9 – Avoiding Over-Trading & Performance DegradationA behavioural-focused module that explains why traders over-trade, how it erodes performance, and how to build systems that maintain discipline and longevity.1

- Module 10 – Hyped Markets, Volatility Events & Mass PsychologyStudents explore the mechanics of hype cycles, volatility spikes, and herd behaviour, learning how to protect capital during emotionally charged market phases.1

- Module 11 – Trading Platforms & Execution SafetyThis module explains how to trade safely across platforms, manage settings, avoid technical errors, and maintain execution reliability under all conditions.1

- Module 12 – Avoiding Indicator & Strategy TrapsStudents learn why traders misuse indicators, fall for “holy grail” strategies, and over-trust mechanical signals, developing a more professional approach to technical tools.1

- Module 13 – The Dangers of Over-OptimisationA practical guide to understanding curve-fitting, data distortion, and over-refined strategies that break in live markets, teaching traders to build more robust systems.1

- Module 14 – Trading Psychology: Identity, Bias & Self-DeceptionThis module addresses the deeper psychological forces that shape decision-making, helping traders understand how identity, ego, and bias influence their results.1

- Module 15 – How to Verify Information & Validate Data LectureStudents learn disciplined fact-checking methods, data validation techniques, and critical-thinking structures that protect them from misinformation and faulty analysis.1

- Module 16 – Risk Management Failures & How to Avoid ThemA comprehensive breakdown of the most common risk-management mistakes, teaching traders how to structure their exposure, limits, and frameworks to prevent catastrophic losses.1

- Module 17 – Fraudulent Signals, Bots & Copy Trading SchemesThis module exposes the mechanics behind fraudulent signal groups, fake bots, and manipulative copy-trading ecosystems, teaching traders how to evaluate legitimacy.1

- Module 18 – The Prop Firm Trap & Evaluation PitfallsStudents explore the hidden risks, evaluation structures, and behavioural traps inside prop firm challenges, learning how to avoid costly mistakes and predatory offerings.1

- Module 19 – Liquidity Traps & Stop ClustersThis module reveals how liquidity pockets form, why stop clusters attract price action, and how institutional flows interact with retail positioning.1

- Module 20 – Protecting Yourself From Operational FailureA practical systems-focused module covering all aspects of operational stability—platform settings, backups, contingencies, and professional trading workflows.1

- Module 21 – Regulation, Compliance & Market StandardsStudents learn the regulatory frameworks governing trading, including compliance expectations and how to identify trustworthy market participants and institutions.1

- Module 22 – Ethical Trading & Long-Term Professional ConductThis module highlights the behavioural and ethical standards that underpin lasting careers, teaching traders how to build credibility, discipline, and professional maturity.1

- Module 23 – Building a Personal Trader Protection FrameworkStudents synthesize everything learned to create a customised protection system covering behaviour, risk, workflow, due diligence, and information validation.1

- Module 24 – Final Integration & Professional Conduct ChecklistThe masterclass concludes with a comprehensive integration of all concepts, providing traders with a structured, long-term blueprint for safe, resilient, and professional trading practice.1

- Trader Protection Masterclass ExamThe Exam evaluates your understanding of all 24 modules of the Trader Protection Masterclass — covering market integrity, behavioural traps, scam awareness, risk management, due diligence, and professional conduct. Timed at 60 minutes with unlimited retakes, it’s the final step to consolidate your protective framework and demonstrate mastery of safe, disciplined, and resilient trading practice.1

- FeedbackShare your learning experience and let us know how the Masterclass has supported your trading journey. Your feedback helps us improve and guides future students in understanding the value of the course.1