Forex Fundamental Analysis Course: The Complete Professional Guide

Introduction

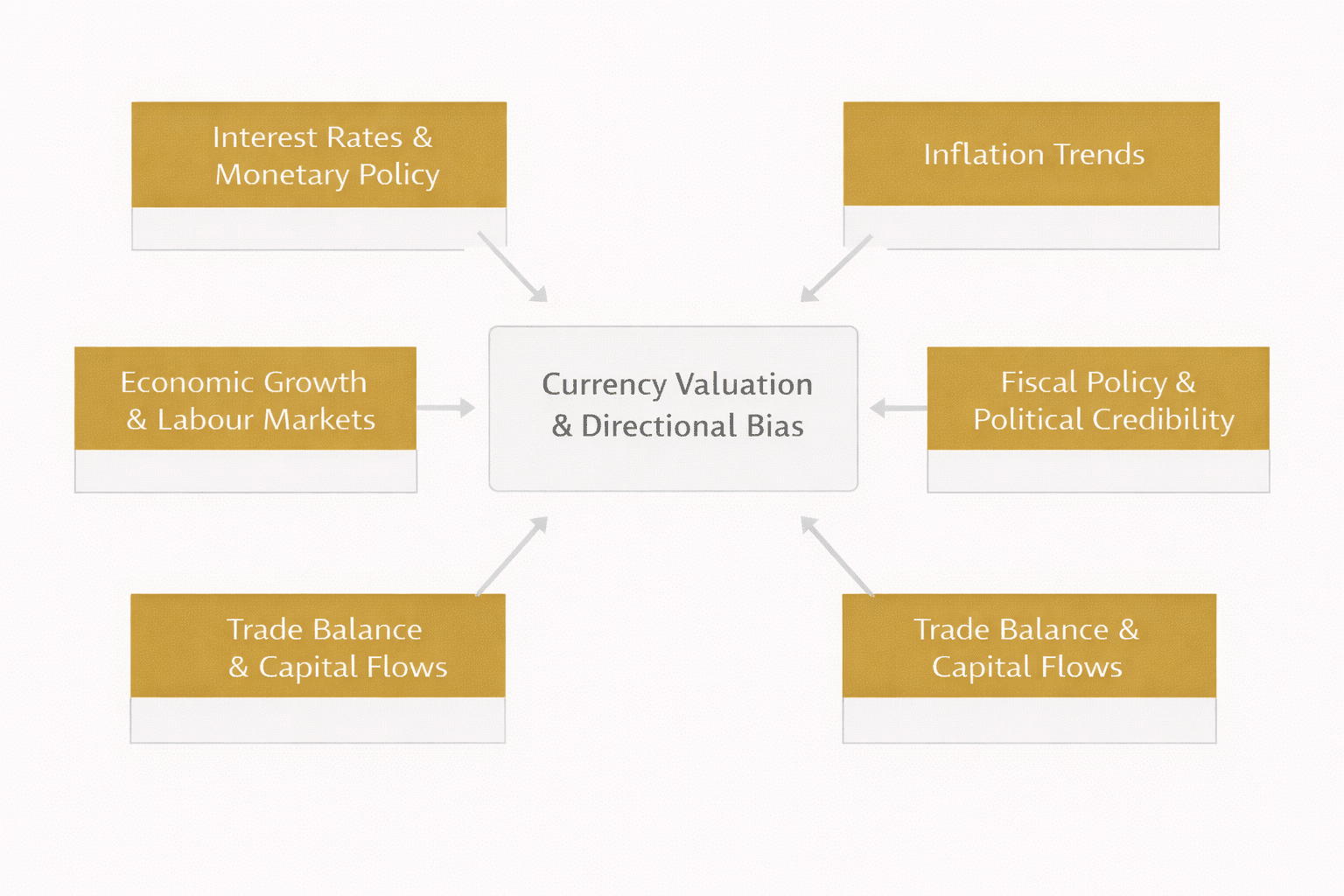

Forex fundamental analysis explains why currency prices move by examining the economic forces that drive capital flows between countries. Unlike chart-only approaches, fundamentals focus on interest rates, inflation, growth, policy expectations, and credibility, which shape medium- and long-term currency trends. This guide delivers a professional, step-by-step framework for understanding forex fundamental analysis, shows how institutions apply it in practice, and explains how to integrate fundamentals with technical execution for consistent decision-making.

Forex fundamental analysis is the study of macroeconomic data, monetary policy, and capital flows to determine the underlying value and directional bias of currencies.

What Forex Fundamental Analysis Actually Measures

Forex fundamental analysis measures relative economic strength and policy direction between two countries. Currencies reprice when expectations change—often before data prints. Professionals therefore assess directional bias (which currency should strengthen) and conviction (how strong that bias is), rather than predicting short-term price ticks.

The Core Drivers of Forex Fundamentals

Interest Rates and Monetary Policy

Interest rates are the dominant driver of currency valuation. Expectations about future policy matter more than the current rate. Traders analyse central bank guidance, voting dynamics, and credibility by following institutions such as the Federal Reserve and the European Central Bank.

Inflation Dynamics

Inflation determines policy constraints. Persistent inflation pressures bias currencies higher if tightening is credible; disinflation shifts expectations toward easing. Professionals compare headline versus core trends and watch services inflation for stickiness.

Economic Growth and Labour Markets

GDP momentum and labour tightness attract capital. Strong growth with low unemployment supports currency demand; deteriorating growth undermines it—especially when paired with easing policy expectations.

Trade Balances and Capital Flows

Current account surpluses, export competitiveness, and portfolio flows create structural demand. Deficits require financing and can pressure currencies during risk-off regimes.

Fiscal Policy and Political Credibility

Debt trajectories, deficits, and governance affect confidence. Weak fiscal discipline or political instability can offset otherwise strong growth.

Authoritative Data Sources Professionals Use

Macro analysis relies on consistent, credible datasets and frameworks from bodies such as the International Monetary Fund and the Bank for International Settlements, alongside national statistical agencies and central banks. The focus is comparability and expectations, not single releases.

A Professional Forex Fundamental Analysis Workflow

Step 1: Map the Macro Regime

Identify the global backdrop—risk-on or risk-off, liquidity expansion or contraction, and policy convergence or divergence.

Step 2: Score Relative Fundamentals

Compare interest-rate expectations, inflation trends, growth momentum, labour conditions, and external balances between currencies.

Step 3: Form a Directional Bias

Decide which currency should outperform and why. Define conviction based on alignment across drivers.

Step 4: Align with Technical Structure

Use charts to time entries and manage risk within the macro bias. Fundamentals answer why; technicals answer when.

Step 5: Reassess on Expectation Shifts

Update the bias when policy guidance, data surprises, or regime conditions change.

Forex Fundamental Analysis vs Technical Analysis vs News

- Fundamental analysis defines direction and conviction.

- Technical analysis structures execution and risk.

- News explains catalysts but is filtered through expectations.

Used together, they reduce false signals and improve consistency.

Common Mistakes in Forex Fundamental Analysis

Traders often overreact to single data points, ignore expectations, misread central bank language, or assume fundamentals provide precise entries. Fundamentals set context; execution requires structure and risk control.

Example: Applying Forex Fundamental Analysis

If inflation cools while growth slows, markets may price earlier rate cuts. A professional assessment weighs policy credibility, yield differentials, and capital flows to identify likely underperformers. Trades are then structured technically, with risk defined before entry.

Why Forex Fundamental Analysis Matters Long-Term

Currencies reflect economic reality over time. Mastering fundamentals builds conviction, patience, and adaptability across cycles. Internal learning paths like a forex fundamentals guide and a currency macro framework deepen this skill set.

FAQs

What is forex fundamental analysis?

Forex fundamental analysis evaluates macroeconomic data, monetary policy, and capital flows to understand why currencies strengthen or weaken over time. It focuses on expectations and relative strength rather than short-term price patterns.

Is forex fundamental analysis better than technical analysis?

Neither is superior alone. Fundamentals define direction and conviction, while technical analysis optimises timing and risk. Professionals combine both to improve consistency and avoid trading against macro trends.

Which indicators matter most in forex fundamentals?

Interest-rate expectations, inflation trends, economic growth, labour markets, trade balances, and fiscal credibility are the primary drivers. Central bank guidance often matters more than single data prints.

Can beginners use forex fundamental analysis effectively?

Yes. Beginners should focus on a small set of drivers—rates, inflation, and policy guidance—and learn to assess expectations rather than reacting to every release. Simplicity improves clarity.

How often do forex fundamentals change?

Fundamentals evolve over weeks and months as expectations shift. Regime changes—policy pivots or growth shocks—matter far more than day-to-day data noise.