Forex Technical Analysis: The Complete Professional Guide

Introduction

Forex technical analysis is the framework traders use to read price behaviour, market structure, and probability without relying on predictions. Instead of asking why a currency moves, technical analysis focuses on how price behaves, where risk can be defined, and when trades can be executed with structure. This guide explains forex technical analysis step by step, shows how professional traders apply it in real markets, and demonstrates how technical analysis integrates with fundamentals to produce consistent, repeatable decision-making.

Forex technical analysis is the study of price action, market structure, and trading behaviour using charts to identify trends, levels, and risk-defined opportunities.

What Forex Technical Analysis Really Does

Forex technical analysis does not forecast the future.

Its purpose is to organise price behaviour into structured patterns so traders can make disciplined decisions under uncertainty. Professionals use technical analysis to define entries, exits, and risk parameters, not to predict exact price targets.

When applied correctly, technical analysis converts uncertainty into controlled probability.

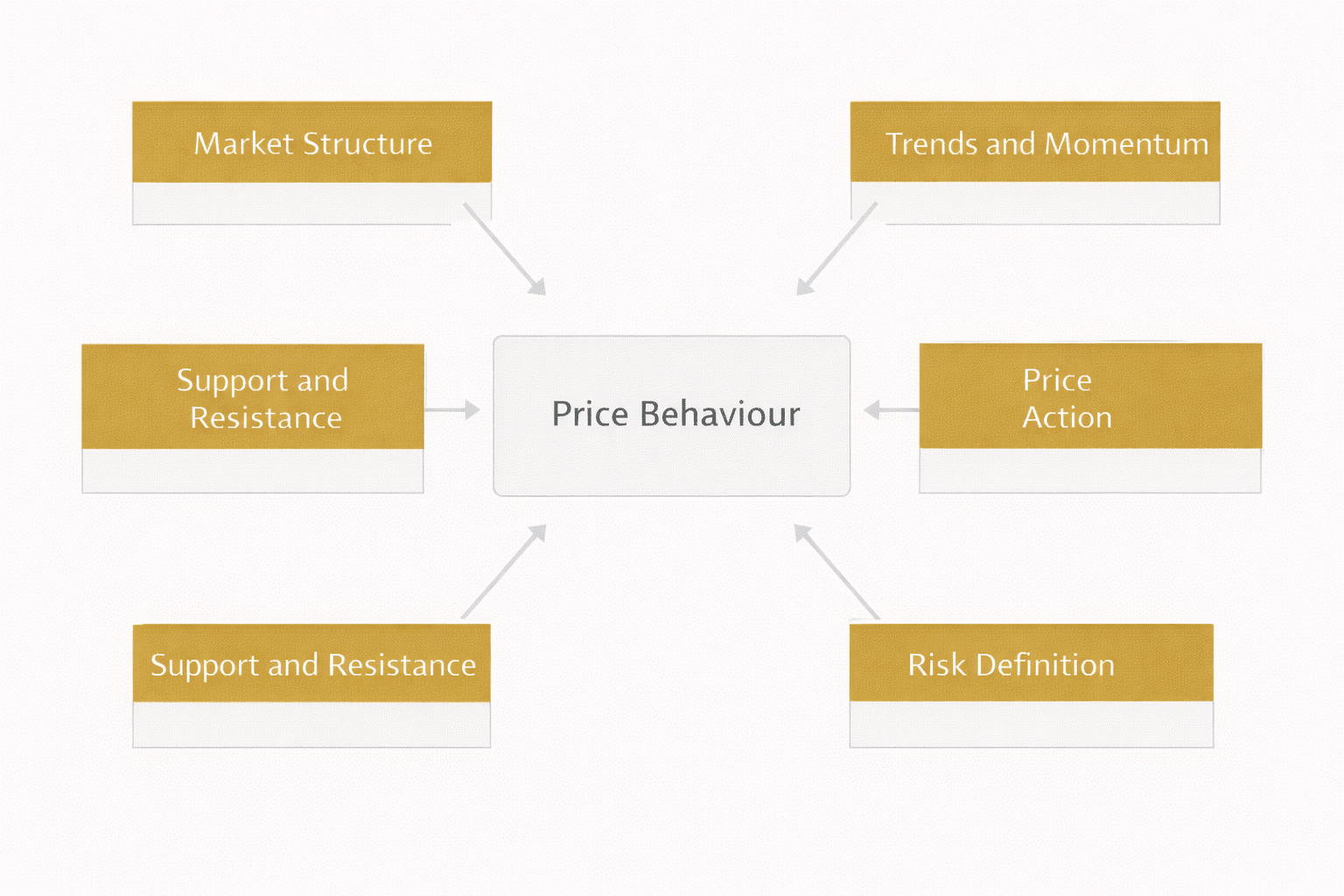

The Core Components of Forex Technical Analysis

Professional forex technical analysis is built on a small number of durable concepts that work across timeframes and market conditions.

Market Structure

Market structure describes how price trends, ranges, and transitions between phases. Higher highs and higher lows define uptrends, while lower highs and lower lows define downtrends.

Understanding structure prevents traders from fighting dominant price direction.

Trends and Momentum

Trends reflect directional bias in price. Technical analysis evaluates whether trends are strengthening, continuing, or weakening rather than searching for constant reversals.

Momentum confirms whether price movement is supported or losing strength.

Support and Resistance

Support and resistance are price zones where buying or selling pressure has previously emerged. These areas help traders plan entries, exits, and stop placement logically.

They are zones of interest, not precise lines.

Price Action

Price action focuses on how candles interact with structure and key levels. It reflects real-time supply and demand behaviour without heavy indicator reliance.

Price action adapts across instruments, sessions, and volatility regimes.

Indicators in Forex Technical Analysis

Indicators summarise price mathematically.

Professional traders use indicators for confirmation and context, not as standalone signals. Overloading charts with indicators often reduces clarity rather than improving results.

A Step-by-Step Forex Technical Analysis Workflow

Professional traders apply technical analysis through a repeatable process.

Step 1: Identify Market Structure

Determine whether the market is trending, ranging, or transitioning. Structure defines what types of trades are appropriate.

Step 2: Establish Directional Bias

Align trades with the dominant trend or range boundaries. Avoid trades that conflict with clear structure.

Step 3: Mark Key Levels

Identify major support and resistance zones on higher timeframes. These levels frame execution on lower timeframes.

Step 4: Wait for Price Confirmation

Use price action or simple confirmation tools near key levels to validate entries rather than anticipating reactions.

Step 5: Define Risk Before Entry

Stop placement is based on structure, not emotion. Position size is determined by risk, not confidence.

Forex Technical Analysis vs Fundamental Analysis vs News

Each approach serves a distinct role.

Technical analysis answers how and when to trade. Fundamental analysis explains why a currency should strengthen or weaken. News provides catalysts but must be filtered through expectations.

Professionals combine all three to avoid technically attractive trades that contradict macro reality.

Common Mistakes in Forex Technical Analysis

Many traders misuse technical analysis.

Common errors include trading without context, ignoring higher timeframes, chasing price, moving stops emotionally, and relying on indicators alone. Simplicity, structure, and discipline matter more than complexity.

Example of Technical Analysis in Practice

In an established uptrend, technical analysis looks for pullbacks toward support rather than chasing highs. Traders wait for price to stabilise, confirm structure, and define risk before entry.

This approach improves consistency and reduces emotional decision-making.

Why Forex Technical Analysis Works Long-Term

Markets change, but price behaviour remains consistent.

Forex technical analysis adapts to trending, ranging, and volatile conditions. Traders who master structure and risk management can apply the same framework across cycles and instruments.

Internal learning paths such as a price action framework or risk-based execution guide naturally extend this skill.

Who Forex Technical Analysis Is Best Suited For

Technical analysis is especially effective for:

- Day traders and swing traders

- Traders focused on execution precision

- Traders managing defined risk

- Traders operating within broader macro bias

It is less effective when used without structure or discipline.

FAQs

What is forex technical analysis?

Forex technical analysis studies price behaviour, market structure, and trends using charts to identify trade opportunities and manage risk.

Is forex technical analysis enough on its own?

Technical analysis can be used alone, but it is more effective when combined with fundamentals that define broader directional context.

Do indicators work in forex technical analysis?

Indicators can be useful for confirmation, but they should not replace structure, price action, and risk-based analysis.

Can beginners learn forex technical analysis?

Yes. Beginners should start with market structure, trends, and support and resistance before adding complexity.

Does forex technical analysis work in all market conditions?

Yes. Technical analysis adapts to trending, ranging, and volatile markets when applied with disciplined risk management.