CPD UK-Certified Forex Trading Course (Professional Mini MBA)

This CPD UK-certified forex trading course is a professional, self-paced online programme structured as a Mini MBA. It teaches how traders analyse, structure, and manage risk in the foreign exchange markets using institutional-grade frameworks.

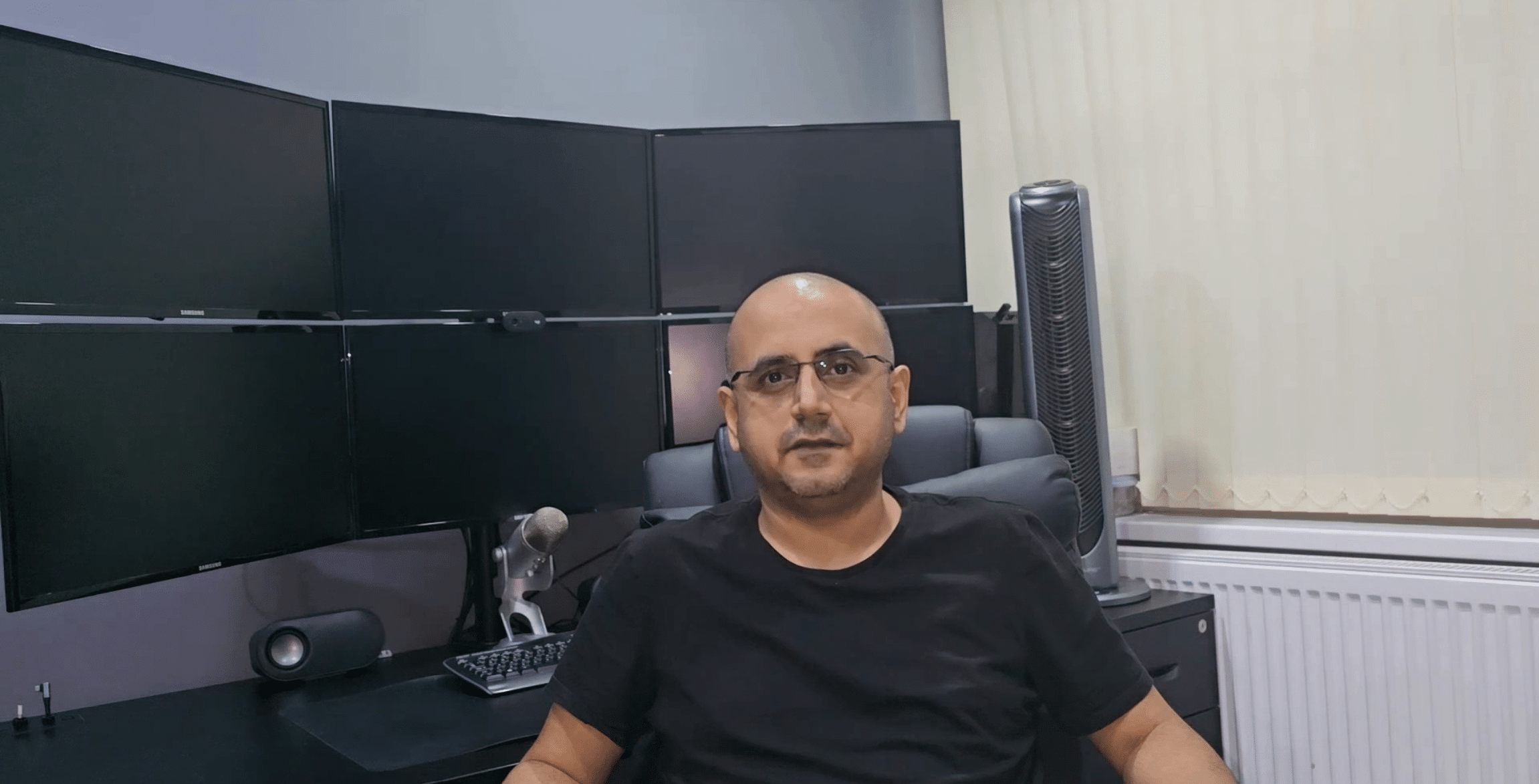

Importantly, the course is led by Sachin Kotecha (17+ years’ experience). As a result, the programme focuses on market structure, macroeconomic drivers, technical analysis, and disciplined decision-making. After completion, learners earn a recognised professional certificate and gain a clear, repeatable approach to forex market analysis.

In simple terms: this forex trading course shows you how to analyse currencies, control risk, and make structured trading decisions. As a result, you do not need to rely on tips, signals, or shortcuts.

Most importantly, this is one of the few CPD UK-certified forex trading courses designed to professional education standards rather than retail speculation.

Who This Forex Course Is Designed For

- Beginners who want a clear, professional foundation

- Retail traders who want a more institutional-level view

- Career switchers exploring professional trading education

- Analysts and investors seeking deeper FX market insight

However, this course is not designed for traders looking for signals, copy trading, mentoring, or fast-profit shortcuts.

If you are still comparing options, you may also find it helpful to read our best forex courses guide, which explains the differences between professional and retail training in more detail.

What You’ll Be Able to Do After Completing This Course

- Analyse currency markets using clear macro and technical frameworks

- Build structured, risk-defined trade ideas with clear logic

- Understand how professional traders make decisions

- Apply disciplined processes across different market conditions

How This Forex Course Works

- Enrolment & Access: First, you receive immediate online access for 12 months.

- Structured Learning: Next, you move from core foundations to advanced application.

- Applied Practice: Then, you reinforce learning through walkthroughs and examples.

- Assessment: After that, formal assessments confirm your understanding.

- Certification: Finally, you receive a CPD UK-accredited certificate.

What You’ll Learn in This Forex Course

- Forex market structure, currency pairs, and execution models

- Technical analysis and price behaviour

- Macroeconomic and fundamental drivers of currencies

- Trend and swing-based analysis frameworks

- Professional risk management principles

- Trading psychology and decision discipline

- Strategy refinement and repeatable routines

- Advanced macro and sentiment tools

FAQs

Is this forex course suitable for beginners?

Yes. The course starts from first principles and then moves step by step toward advanced professional frameworks.

Is this forex course certified?

Yes. You receive a CPD UK-accredited professional certificate when you complete the course.

Is this course self-paced?

Yes. The course runs fully online and remains available for 12 months.

Does this course provide signals or mentoring?

No. Instead, this programme focuses on analysis, process, and risk management.

Curriculum

- 24 Sections

- 23 Lectures

- 1 Year Access

- 1. Introduction To The Mini MBAThis module sets the foundation for professional FX trading by outlining the full systematic process you’ll use throughout the programme. You’ll understand how macroeconomics, fundamentals, technicals, risk management and discipline integrate into a single repeatable workflow that underpins consistent performance.1

- 2. Understanding Currencies & Exchange RatesLearn how global currency systems evolved, how fixed and floating regimes work, and why FX markets behave the way they do. You’ll gain the structural knowledge required to understand volatility, competitiveness, and the forces driving exchange-rate movements.2

- 3. Identifying Tradeable OpportunitiesDiscover how professional traders filter the FX market for volatility, liquidity and macro-driven catalysts. This module teaches you to spot high-probability environments and avoid low-quality setups that waste time, capital and focus.2

- 4. Forex Market Infrastructure ExplainedA comprehensive breakdown of all market participants—central banks, corporations, hedge funds, banks, brokers and governments—and how their actions drive currency flows. You’ll understand who moves the market, why they act, and how their behaviour creates tradeable trends.2

- 5. Understanding Macroeconomic DriversA deep dive into the macro indicators that influence currencies: inflation, growth, labour markets, trade, fiscal policy and sentiment. You’ll learn why macro is the engine of FX and how data shapes long-term directional moves.2

- 6. Fundamental Macroeconomic AnalysisThis module teaches you how to translate macro data into bullish or bearish currency biases. You’ll build conviction through structured scoring and learn to generate fundamentally driven trade ideas based on real economic strength and weakness.2

- 7. Basic Chart AnalysisMaster the core building blocks of technical analysis: support, resistance, trendlines, moving averages, RSI, Fibonacci and market structure. You’ll learn how price reflects psychology and how to read charts with clarity and precision.2

- 8. Chart Platform TrainingGet fully proficient with TradingView, the professional charting platform used throughout the course. You’ll learn how to apply tools, annotate charts, manage watchlists, set alerts and build a clean, efficient technical workflow.2

- 9. Chart Pattern AnalysisExplore candlestick behaviour in depth, including reversal and continuation patterns such as engulfings, stars, hammers, tweezers, and gap formations. This module elevates your timing, accuracy and execution across all market conditions.2

- 10. Advance Technical AnalysisA full introduction to the Ichimoku system—one of the most powerful trend-analysis frameworks in trading. You’ll understand each component, how the cloud forms, and how to interpret long-term equilibrium and momentum.2

- 11. Advance Technical Analysis StrategiesLearn how to turn Ichimoku theory into actionable trading strategies. You’ll understand entry confirmation, crossovers, Kumo dynamics, multi-timeframe alignment and trend-following techniques used by institutional traders.2

- 12. Advance Technical Analysis Examples 1Apply advanced technical tools to real charts, combining price action, candlestick patterns and Ichimoku to build highly accurate technical narratives. This module strengthens your pattern recognition and execution discipline.2

- 13. Advance Technical Analysis Examples 2A continuation of live technical walkthroughs, showing how professional traders validate signals, filter out false breakouts, and synchronise multiple indicators for higher-probability setups.2

- 14. Advance Technical Analysis Examples 3Further real-market examples illustrating full technical confluence. This module reinforces how advanced techniques work together to generate reliable timing signals for both entries and exits.2

- 15. Trading Risk ManagementLearn the professional frameworks that protect capital and ensure long-term survivability. This includes position sizing, exposure management, volatility adaptation, correlation control, and portfolio-level risk governance.2

- 16. Correlated Forex Risk AnalysisUnderstand how currency correlations amplify or dilute portfolio risk. You’ll learn to avoid concentrated exposures, manage cross-pair relationships, and build portfolios that reflect professional-grade diversification.2

- 17. Trading PsychologyA complete exploration of trader mindsets, behavioural biases, fear, greed, FOMO, overconfidence and loss aversion. You’ll learn the mental frameworks that separate consistent traders from those who self-sabotage.2

- 18. Trading Plan & DisciplineBuild a structured trading plan covering strategy, risk rules, entries, exits, journalling and emotional management. You’ll learn to systemise your process, stay objective, and enforce discipline across all market environments.2

- 19. Common Trading Mistakes & Market WisdomA breakdown of the errors that destroy retail traders—over-trading, revenge trading, poor sizing, no stops, following the crowd—and how to eliminate them. The module delivers practical wisdom for long-term consistency.2

- 20. Putting It All Together Example 1A full start-to-finish demonstration of the complete trading process, combining macro scoring, fundamental analysis and technical execution to generate a professional-quality trade idea.2

- 21. Putting It All Together Example 2A second full walkthrough showing how to align economic data, currency strength, sentiment and chart analysis. You’ll see how the process adapts across different market conditions.2

- 22. Putting It All Together Example 3A final comprehensive example illustrating advanced decision-making, risk management, trade exits and scenario handling when fundamentals and technicals evolve over time.2

- 23. Final ExamYour final assessment covering macroeconomics, fundamentals, technicals, psychology, risk, and the full systematic process. Passing the exam confirms your mastery of the Mini MBA framework.1

- FeedbackA dedicated space for reflections, performance review and personalised guidance to strengthen your trading development and close skill gaps.1