Gold Trading Course

Develop a structured understanding of gold through macroeconomics, monetary policy, and market behaviour with this in-depth Gold Trading Course. Designed for learners seeking a professional understanding of the key forces that influence gold pricing, the programme explores inflation dynamics, interest rates and real yields, central bank activity, geopolitics, and risk cycles. The focus is on building a professional framework for interpreting gold’s role across market regimes, supporting disciplined analysis and risk-aware evaluation rather than signals or trade instruction.

About This Gold Trading Course

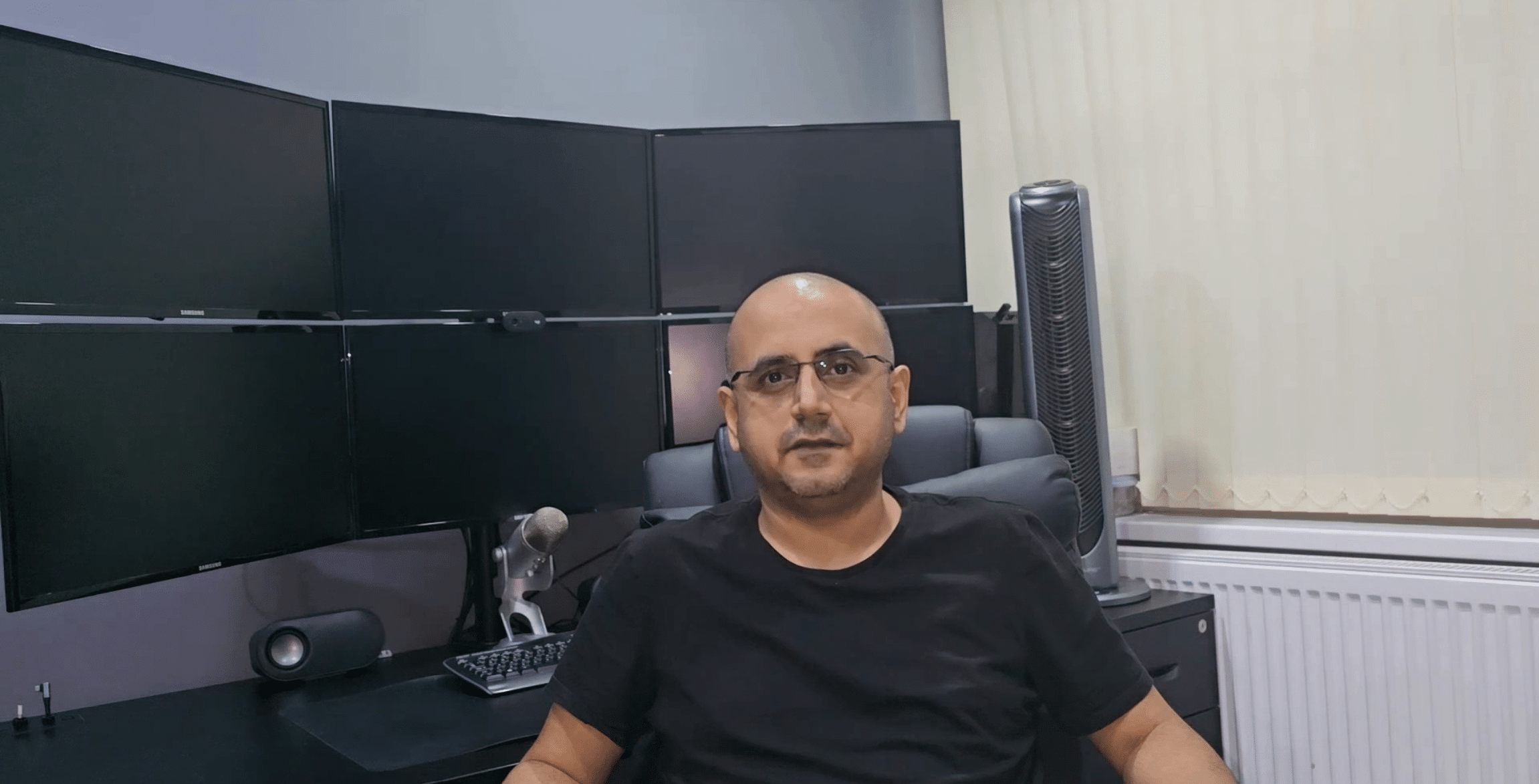

Across 24 professionally structured modules, this programme — created and presented by Sachin Kotecha — provides a disciplined, professional-grade education in gold market analysis. You will learn how macro conditions, central bank behaviour, geopolitical developments, and safe-haven demand can influence gold pricing over time. The course is designed to strengthen analytical clarity and support evaluation of gold within a structured framework, with an emphasis on process, risk awareness, and disciplined decision-making.

Why Gold Trading Matters

Gold is widely followed because it can reflect inflation expectations, confidence conditions, fiscal stability, and shifts in global risk sentiment. Changes in real yields, policy expectations, and geopolitical stress can all affect how gold is priced. This Gold Trading Course explains these relationships and helps you understand how gold interacts with factors such as the US dollar, liquidity conditions, and broader macro policy signals, supporting a structured and informed approach to market interpretation.

What You’ll Learn in This Course

Across 24 modules, you’ll build a complete analytical framework for evaluating gold:

- Assess inflation, interest rates, and real yields, and understand how they influence gold conditions across different regimes.

- Interpret central bank activity, reserve trends, ETF flows, and positioning data as part of a broader market context.

- Evaluate geopolitics, fiscal policy, and global liquidity as drivers of longer-term gold behaviour.

- Apply technical tools, sentiment context, and seasonality as part of disciplined scenario analysis and market assessment.

- Compare gold with related metals and cross-asset rotation dynamics to improve contextual understanding.

- Consider portfolio use-cases, hedging concepts, and risk-cycle behaviour within a broader asset-allocation lens.

By the end of this Gold Trading Course, you will be able to interpret key macro and market inputs more clearly and apply a structured process to evaluating gold across changing conditions.

Who This Course Is For

This course is designed for individuals seeking a structured understanding of gold in a global context. It suits retail market participants developing structured knowledge, macro-focused investors building deeper insight, and market professionals who want a structured approach to gold analysis. No prior commodities experience is required.

What Makes This Course Unique

Unlike generic introductions, this Gold Trading Course prioritises macroeconomic structure and real-world market context. Lectures use clear, narrative-led explanations and case studies to show how gold has responded to policy shifts, liquidity changes, and periods of heightened uncertainty. The emphasis is on building a repeatable analytical method that supports disciplined market interpretation rather than prediction or outcome-led decision-making.

Analytical and Professional Development Outcomes

By completing the Gold Trading Course, you’ll develop a structured approach to interpreting macroeconomic data, sentiment context, and cross-asset dynamics as they relate to gold. You’ll learn how gold can behave across different risk environments and how professionals contextualise gold within broader portfolios and market regimes. The objective is to strengthen analytical judgement, preparation quality, and consistency in market evaluation.

Enrol Today

If you want to build a clearer, macro-informed framework for analysing gold, you can enrol in the Gold Trading Course and complete the programme at your own pace through the online platform.

FAQs

How long does it take to complete the Gold Trading Course?

The course is structured around 24 modules, each lasting approximately 15–20 minutes, allowing you to complete it at your own pace over four to six weeks.

Is the Gold Trading Course suitable for beginners?

Yes. The course is designed for all experience levels, starting from first principles and progressing to macro and technical analysis frameworks.

Does the Gold Trading Course include mentoring or live sessions?

This is a fully self-paced masterclass featuring professionally narrated HD lectures and a final multiple-choice exam to consolidate learning.

Will I receive a certificate upon completion?

Yes. You’ll receive a personalised digital certificate of completion recognising successful completion of the programme.

What materials are included?

You’ll gain access to expert video lectures, downloadable reference notes, and a final assessment within the course platform.

Curriculum

- 27 Sections

- 26 Lectures

- 6 Weeks

- Introduction To The Gold Trading MasterclassThis introduction sets the stage for the entire Gold Trading Masterclass, revealing how global economic forces, monetary policy, and investor psychology shape the price of gold. It explains gold’s unique dual identity as both a commodity and a monetary asset, introduces the macroeconomic themes that influence its behaviour — from inflation and interest rates to risk sentiment and central-bank action — and prepares learners to think beyond price charts, understanding gold as a living reflection of trust, value, and global financial dynamics.1

- Module 1 – Understanding the Global Gold MarketThis module introduces you to the structure of the global gold market — from mining and refining to ETFs, futures, and central-bank reserves. You’ll explore how supply chains, institutional flows, and investor sentiment interact to move prices, giving you a clear foundation for analysing gold as both a commodity and a monetary asset.1

- Module 2 – The History and Monetary Role of GoldTrace gold’s evolution from ancient currency to modern financial anchor. This module explains how gold shaped global trade, monetary systems, and investor psychology, revealing why it continues to hold value in an era of digital money and fiat currencies.1

- Module 3 – Gold as a Safe-Haven AssetDiscover why gold remains the ultimate refuge during crises. You’ll learn how fear, uncertainty, and policy responses drive demand for gold in inflationary, deflationary, and geopolitical shocks — and how to recognise these setups before the crowd.1

- Module 4 – Macroeconomic Drivers of Gold PricesUncover the key macro forces that move gold: inflation expectations, real yields, growth cycles, and monetary policy. This module shows you how to connect economic data with price reactions, turning global news into actionable trading insight.1

- Module 5 – Inflation, Interest Rates, and Real YieldsLearn why the relationship between inflation, interest rates, and real yields sits at the heart of gold’s long-term trend. You’ll see how professional traders track these metrics to forecast when gold will rise, consolidate, or fall.1

- Module 6 – Central Banks and Gold ReservesExplore how central banks use gold to build confidence, manage currency risk, and hedge geopolitical exposure. This module reveals how official gold purchases and sales shape long-term price trends — and what they signal to traders.1

- Module 7 – The US Dollar and Gold’s Inverse CorrelationUnderstand why gold and the US dollar move in opposition — and when they don’t. You’ll examine how yield differentials, liquidity cycles, and policy expectations influence this relationship and how to use it to refine timing and positioning.1

- Module 8 – Commodities, Currencies, and the Gold LinkSee gold’s role within the broader commodity ecosystem. You’ll learn how it connects with oil, copper, and major currency pairs, and how shifts in global demand, inflation, and trade flows create ripple effects across markets.1

- Module 9 – Gold and Geopolitical RiskThis module explores how wars, sanctions, and political instability influence gold prices. You’ll study case studies from major crises and learn to identify early warning signs that drive safe-haven flows into gold.1

- Module 10 – Fiscal Policy, Debt, and Gold DemandUnderstand how government spending, debt accumulation, and fiscal dominance affect gold’s long-term value. This module teaches you to interpret budget deficits, bond markets, and sovereign risk through a gold trader’s lens.1

- Module 11 – ETF Flows, Futures, and Institutional ParticipationDiscover how ETFs, futures contracts, and institutional players dominate gold trading today. You’ll learn how fund flows, speculative positioning, and hedging activity shape short-term price moves and long-term sentiment.1

- Module 12 – Mining, Supply Chains, and Production EconomicsGo behind the scenes of gold production — from exploration and extraction to refining and recycling. You’ll see how energy costs, regulation, and supply constraints create structural trends that traders can anticipate.1

- Module 13 – Global Demand: Jewellery, Investment, and IndustryLearn how physical demand for jewellery, bars, coins, and industrial uses influences gold’s price stability. This module breaks down regional trends and consumer behaviour that underpin the physical side of the market.1

- Module 14 – The Role of Emerging Markets in Gold DemandExplore how nations like India, China, and Turkey drive global gold consumption. You’ll understand the cultural, economic, and policy factors that make emerging markets the heartbeat of physical gold demand.1

- Module 15 – Technical Analysis for Gold TradersCombine chart reading with macro understanding. You’ll master support and resistance, trend structure, and momentum indicators like RSI and MACD — learning how professionals use technicals to time entries and exits.1

- Module 16 – Sentiment, Seasonality, and Market PsychologyUnderstand how human emotion drives price cycles. This module teaches you how to read market sentiment, interpret positioning data, and leverage gold’s seasonal patterns to anticipate momentum shifts.1

- Module 17 – Gold vs. Silver, Platinum, and Other MetalsCompare gold’s performance to silver, platinum, and industrial metals. You’ll see how relative strength, volatility, and cross-asset ratios reveal macro turning points and investor risk appetite.1

- Module 18 – Energy Prices and Their Impact on GoldLearn how oil and energy markets influence inflation, production costs, and monetary policy — and why gold often reacts to these shifts ahead of other assets. This module connects energy cycles directly to gold trading opportunities.1

- Module 19 – Risk-On vs. Risk-Off Cycles in Gold MarketsGrasp how global sentiment swings between optimism and fear affect gold. You’ll study how liquidity, credit spreads, and volatility indices help you identify when markets are about to pivot between risk-on and risk-off regimes.1

- Module 20 – Gold in Portfolio Diversification and Hedge FundsDiscover how institutional investors use gold as a hedge against inflation, volatility, and systemic risk. You’ll learn how to integrate gold into diversified portfolios and understand its performance across different macro cycles.1

- Module 21 – Algorithmic and AI-Driven Gold Trading ModelsSee how algorithms and AI are transforming gold trading. This module explains how quantitative models analyse price data, sentiment, and macro indicators to generate automated strategies and predictive insights.1

- Module 22 – Regulation, Transparency, and the Future of Gold MarketsExplore how regulation, compliance, and reporting standards are reshaping gold markets. You’ll understand the role of global exchanges, trade data, and transparency initiatives in maintaining trust and integrity.1

- Module 23 – Environmental, Social, and Ethical Gold SourcingLearn about responsible gold sourcing and the growing importance of ESG standards. This module highlights how sustainability, ethics, and traceability are influencing investor behaviour and industry practices.1

- Module 24 – The Future of Gold in Global FinanceConclude the masterclass by looking ahead. You’ll explore gold’s evolving role in a world of digital currencies, tokenisation, and multipolar monetary systems — and what that means for traders and investors in the years to come.1

- Gold Trading Masterclass ExamThe Exam tests your knowledge across all 24 modules of the Gold Trading Masterclass, covering market structure, macroeconomic drivers, trading psychology, and risk management. Timed at 60 minutes with unlimited retakes, it’s the final step to consolidate your learning and earn your personalised course completion certificate.1

- FeedbackShare your learning experience and let us know how the Masterclass has supported your trading journey. Your feedback helps us improve and guides future students in understanding the value of the course.1