Trading Psychology Course

Develop a more disciplined, process-led approach to market decision-making with the Trading Psychology Masterclass. This structured educational programme focuses on the behavioural and psychological factors that influence trading behaviour, including emotional regulation, attention control, confidence calibration, and decision discipline. Across 24 modules, you’ll learn practical frameworks used in professional environments to strengthen consistency, reduce impulsive reactions, and support clearer thinking under pressure.

About This Trading Psychology Course

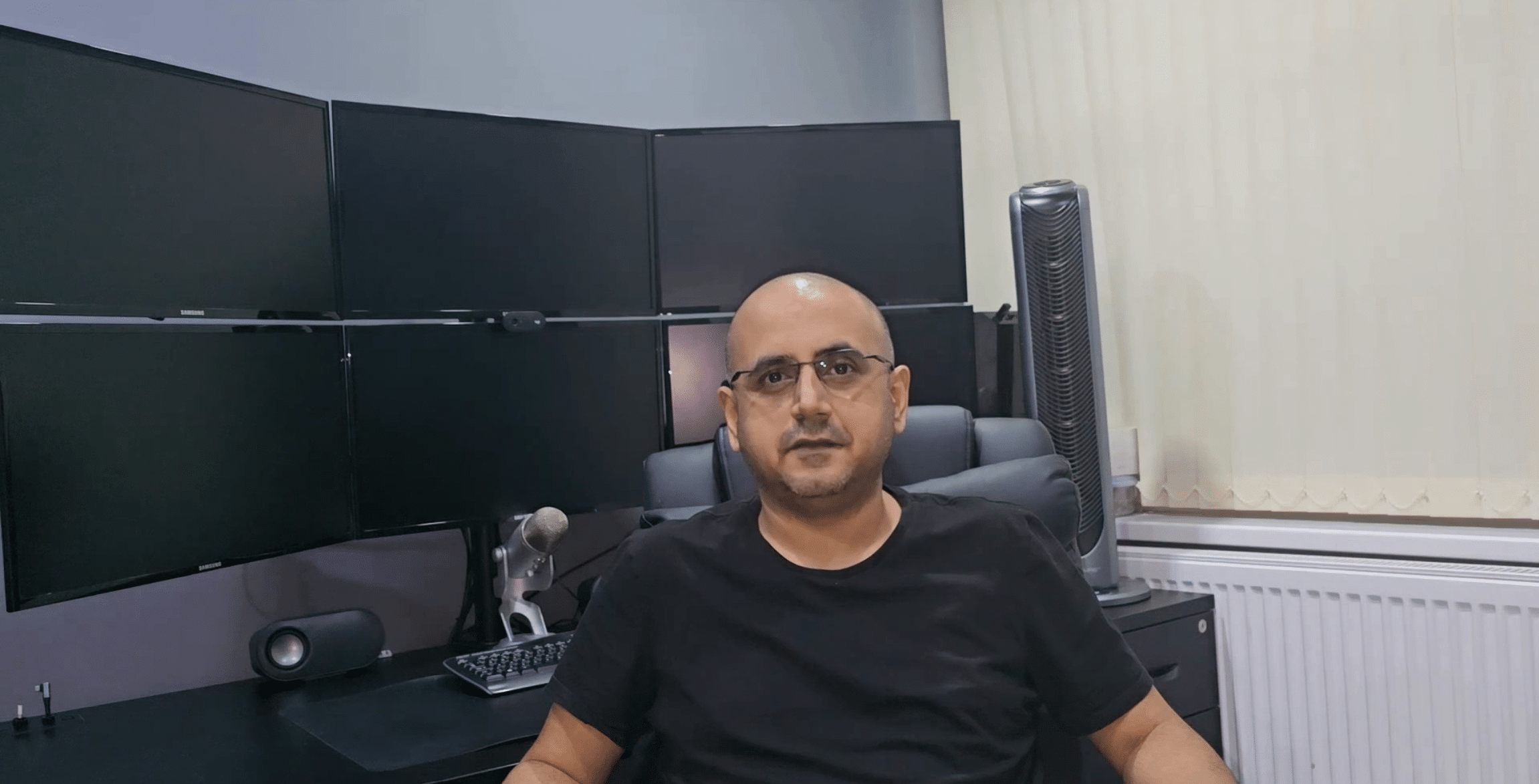

Across 24 professionally structured modules, this programme — created and presented by Sachin Kotecha — provides a professional education in trading psychology. You will explore how behaviour, emotion, and cognitive bias can affect market decisions, and how structured routines and clear rules can support more consistent execution. The course is designed for clarity and real-world application, with an emphasis on disciplined process rather than outcomes or performance claims.

Why Trading Psychology Matters

Markets create uncertainty and pressure, and those conditions can amplify emotional decision-making. Even well-designed strategies can be undermined by behaviours such as hesitation, overtrading, revenge trading, or abandoning rules after a loss. This Trading Psychology Masterclass focuses on building self-awareness, strengthening decision hygiene, and creating routines that support calm, methodical market participation across different conditions.

What You’ll Learn in This Course

Across 24 modules, you’ll develop a structured psychological toolkit to support disciplined trading behaviour:

- Understand how emotion and stress can influence judgement, attention, and decision-making.

- Build routines that support focus, patience, and consistency over time.

- Recognise common cognitive biases that can distort perception and execution.

- Develop methods for managing outcome-focus and maintaining rule-based behaviour.

- Apply practical techniques to improve recovery after mistakes and reduce repeated errors.

- Strengthen resilience and composure in volatile or uncertain market environments.

By the end of this Trading Psychology Masterclass, you’ll have a clearer, repeatable approach to managing behaviour under pressure, supporting more consistent application of your own trading methodology.

Who This Course Is For

This course is designed for traders at any level who want to improve consistency by strengthening behavioural discipline. It is particularly relevant for those who experience emotional reactions, rule-breaking, overtrading, or inconsistency, and for experienced traders looking to formalise their psychological process as part of a professional workflow.

What Makes This Course Unique

This Trading Psychology Masterclass is designed for practical application. Modules are structured, time-efficient, and focused on actionable behavioural frameworks, delivered in clear professional British English. The emphasis is on repeatable process design—so you can build a more stable decision environment, reduce avoidable errors, and strengthen discipline within your own approach.

Career and Trading Benefits

Completing the Trading Psychology Masterclass supports more consistent preparation, calmer decision-making, and improved rule adherence. These behavioural skills can benefit traders across different asset classes and timeframes, and may also transfer into broader professional performance areas such as focus, resilience, and decision quality under pressure.

Enrol Today

If you want to build stronger discipline, clearer routines, and more controlled decision-making under uncertainty, you can enrol in the Trading Psychology Masterclass and complete the programme at your own pace through the online platform.

FAQs

How long does it take to complete the Trading Psychology Masterclass?

The course is structured across 24 modules, each lasting around 15–20 minutes. You can complete it at your own pace, typically within four to six weeks.

Is the Trading Psychology Masterclass suitable for beginners?

Yes. The course is designed for traders at all levels, from beginners building discipline to experienced traders refining consistency.

Is it self-paced learning?

Yes. The Trading Psychology Masterclass is fully self-paced, giving you flexibility to study whenever it suits you. You’ll have access to all 24 video modules and a final exam within the course platform.

Will I receive a certificate upon completion?

Yes. Upon successfully completing the final exam, you’ll receive a digital certificate from Traders MBA recognising completion of the programme.

What materials are included?

The course includes 24 on-demand video modules and a final multiple-choice exam, designed to support a clear and focused learning journey.

Curriculum

- 27 Sections

- 26 Lectures

- 6 Weeks

- Introduction To The Trading Psychology MasterclassThe Trading Psychology Masterclass is a transformative journey into the mindset behind consistent trading success. It reveals how emotions, habits, and self-awareness shape every decision, helping traders replace fear, greed, and impulse with discipline, confidence, and composure. Designed for all experience levels, it teaches you to master yourself first — so you can trade with clarity, control, and true professionalism.1

- Module 1 – The Mind of a Trader: Understanding Yourself FirstThis module explores the foundation of trading psychology — self-awareness. It reveals how emotions, beliefs, and personal history shape trading behaviour and performance. Learners discover that success begins not with market knowledge but with mastering the internal dialogue, emotional triggers, and mindset patterns that influence every decision.1

- Module 2 – The Psychology of Risk and RewardHere we examine how the human brain perceives risk and reward, showing why traders often act irrationally under pressure. The module teaches how to manage fear and excitement, align risk tolerance with strategy, and build emotional resilience to make logical, process-based decisions in uncertain markets.1

- Module 3 – Fear, Greed, and the Emotional Cycle of TradingThis module unpacks the emotional forces that drive markets and individual behaviour. It guides traders through recognising and neutralising fear and greed, understanding their cyclical influence on market sentiment, and developing the ability to act rationally when others are ruled by emotion.1

- Module 4 – The Science of Decision-Making Under PressureStudents learn how the brain responds to stress and uncertainty, and why logic often breaks down in volatile conditions. This session teaches practical techniques to improve decision quality under pressure through awareness, structure, and physiological control.1

- Module 5 – Cognitive Biases and Trading ErrorsThis module reveals how invisible mental shortcuts — biases like confirmation, anchoring, and recency — distort judgment and cause costly mistakes. Traders learn to identify these biases, counteract them with data-driven analysis, and build habits of objective thinking.1

- Module 6 – The Role of Confidence, Doubt, and OvertradingLearners explore the fine balance between self-belief and restraint. The module exposes how both overconfidence and insecurity lead to overtrading and emotional decisions, while teaching how to cultivate grounded, process-based confidence through consistency and discipline.1

- Module 7 – The Power of Emotional RegulationFocusing on control under stress, this module explains how emotions affect trading outcomes and how to regulate them effectively. It introduces methods like breathing, reframing, and cognitive discipline to prevent impulsive reactions and maintain composure in all market conditions.1

- Module 8 – Building Discipline and ConsistencyDiscipline is reframed as the foundation of professional trading. This module shows how to transform good intentions into reliable habits, create routines that anchor focus, and design systems that enforce consistency across all trades, even during emotional volatility.1

- Module 9 – Ego, Impulse, and Self-Sabotage in TradingHere, the spotlight is on ego — the hidden driver of revenge trading, denial, and emotional turbulence. The module helps traders dismantle self-sabotaging habits by replacing ego-based reactions with humility, detachment, and self-awareness.1

- Module 10 – Developing a Professional Trader’s MindsetThis session transitions traders from an amateur to a professional mentality. It focuses on accountability, process orientation, and emotional neutrality, showing how consistent thinking and behaviour create consistent results over time.1

- Module 11 – Patience, Timing, and Emotional Timing WindowsPatience is revealed as a skill, not a personality trait. This module explores emotional timing, teaching traders how to wait for optimal setups, align with market rhythm, and avoid the psychological traps of impatience and overanticipation.1

- Module 12 – The Neuroscience of Trading BehaviourStudents uncover the brain mechanisms behind decision-making, emotion, and stress. By understanding how dopamine, cortisol, and neural wiring affect behaviour, traders learn to reprogram habits and strengthen cognitive control for rational performance.1

- Module 13 – Flow State and Peak Performance in TradingThis module teaches traders how to achieve “flow” — the mental state of total focus and effortless execution. It explains how to structure routines, environments, and mental triggers to reach this optimal zone of concentration and performance.1

- Module 14 – The Psychology of Loss, Recovery, and ResilienceLosses are reframed as feedback, not failure. This module helps traders build resilience by understanding the emotional and physiological impact of loss, developing recovery systems, and learning to bounce back stronger and more balanced.1

- Module 15 – Mindfulness and Focus Training for TradersLearners discover how mindfulness enhances clarity, focus, and emotional regulation. Practical exercises teach how to remain present, reduce cognitive noise, and sustain attention during high-stress trading sessions for sharper decision-making.1

- Module 16 – Building and Sticking to a Trading PlanThis module focuses on the discipline of structure. Traders learn how to design effective plans that integrate psychology, risk management, and strategy — and how to maintain adherence even under emotional or market pressure.1

- Module 17 – Accountability and Self-Evaluation SystemsProfessional growth begins with accountability. This module trains traders to track performance honestly, use journals and KPIs for behavioural analysis, and turn self-evaluation into a continuous improvement process.1

- Module 18 – Handling Drawdowns and Avoiding Revenge TradingDrawdowns test a trader’s emotional limits. This session teaches how to manage performance slumps calmly, avoid the destructive urge to “win it back,” and apply structured recovery techniques to protect capital and confidence.1

- Module 19 – Confidence Without Arrogance: Balancing Emotion and LogicConfidence is reframed as composure under uncertainty. The module shows how to build genuine, evidence-based confidence while staying humble and logical — balancing boldness with discipline to avoid overreach and denial.1

- Module 20 – Risk Tolerance, Position Sizing, and Mental Comfort ZonesThis lecture connects psychology to risk management. Traders learn to define their mental comfort zones, size positions in alignment with emotional stability, and sustain consistency through adaptive, realistic risk control.1

- Module 21 – The Role of Routine, Environment, and PreparationPerformance psychology meets structure in this module, highlighting how environment, routines, and daily preparation affect mindset and results. Traders learn to design habits and workspaces that promote calm focus and optimal execution.1

- Module 22 – Social Influence, Herd Behaviour, and Market SentimentStudents explore how group psychology drives market trends and personal decisions. The module teaches how to recognise herd mentality, detach from social bias, and interpret sentiment as data rather than emotion.1

- Module 23 – Long-Term Mindset: Thinking Like a Fund ManagerThis session elevates perspective from short-term outcomes to long-term consistency. It instills patience, process focus, and capital preservation — the hallmarks of professional money management and sustainable growth.1

- Module 24 – Becoming the Professional Trader WithinThe final module integrates all previous lectures into one philosophy of professionalism. It’s about embodying emotional mastery, integrity, and disciplined structure — transforming trading from an activity into a lifelong practice of performance excellence.1

- Trading Psychology Masterclass ExamThe Exam tests your knowledge across all 24 modules of the Gold Trading Masterclass, covering market structure, macroeconomic drivers, trading psychology, and risk management. Timed at 60 minutes with unlimited retakes, it’s the final step to consolidate your learning and earn your personalised course completion certificate.1

- FeedbackShare your learning experience and let us know how the Masterclass has supported your trading journey. Your feedback helps us improve and guides future students in understanding the value of the course.1