Forex Mentoring – CPD-Certified One-to-One Forex Coaching

The CPD UK-Certified Forex Mentoring programme combines structured professional forex education with twelve private one-to-one mentoring sessions. You complete the Applied Professional Forex Trading Mini MBA and work directly with Sachin Kotecha to build a disciplined, repeatable forex trading analysis framework grounded in macroeconomic context, technical structure, and risk control.

Forex mentoring is a structured one-to-one forex coaching programme that combines CPD-accredited education with personalised guidance to develop independent trading competence. The objective is not signals or copy trading, but professional decision-making, risk discipline, and a repeatable forex analysis process.

What Is Forex Mentoring?

Forex mentoring is a professional forex training pathway designed for traders who want more than a standalone course. It combines:

- A complete CPD-certified forex trading curriculum

- Structured one-to-one forex coaching sessions

- Applied feedback on your analytical process

- Risk management refinement and discipline systems

- Professional forex education aligned to real market conditions

Unlike retail trading signal services or “copy my trades” models, this forex mentorship programme focuses on independent skill development. You learn how to analyse currency markets using structured macro, fundamental, and technical frameworks.

Forex Mentoring vs Forex Course vs Trading Signals

Forex mentoring provides personalised guidance and structured review alongside education.

A forex course provides structured content without individualised coaching.

Trading signals provide trade ideas without teaching independent analytical competence.

This programme is built for traders who want to understand why decisions are made, not simply follow instructions.

How the One-to-One Forex Coaching Works

You progress through the full Applied Professional Forex Trading Mini MBA and use twelve one-hour mentoring sessions to implement structured analytical workflows.

- Baseline Assessment: Evaluate current knowledge and define structured objectives.

- Macroeconomic Integration: Apply inflation, interest rate, growth, and labour data to currency bias.

- Technical Structure Application: Implement trend, momentum, and structure frameworks.

- Risk & Exposure Control: Refine position sizing logic and scenario planning.

- Case Study Review: Analyse trade ideas as structured educational exercises.

- Consistency & Psychology: Build routines and behavioural discipline systems.

Each session strengthens clarity, consistency, and professional judgement in forex market analysis.

What You Learn in This Forex Mentorship Programme

- How the forex market operates across global sessions

- How central bank policy impacts currency valuation

- How to structure macroeconomic trade hypotheses

- Advanced technical analysis frameworks

- Professional risk management systems

- Trading psychology and behavioural discipline

- Decision-making under uncertainty

Full Curriculum Overview

- Introduction to the Mini MBA

- Understanding Currencies & Exchange Rates

- Identifying Tradeable Opportunities

- Forex Market Infrastructure

- Macroeconomic Drivers & Policy Analysis

- Fundamental Analysis Frameworks

- Technical Analysis Foundations

- Advanced Technical Strategies

- Risk Management & Correlation

- Trading Psychology & Discipline

- Integrated Market Workflow

- Final Exam & CPD Certification

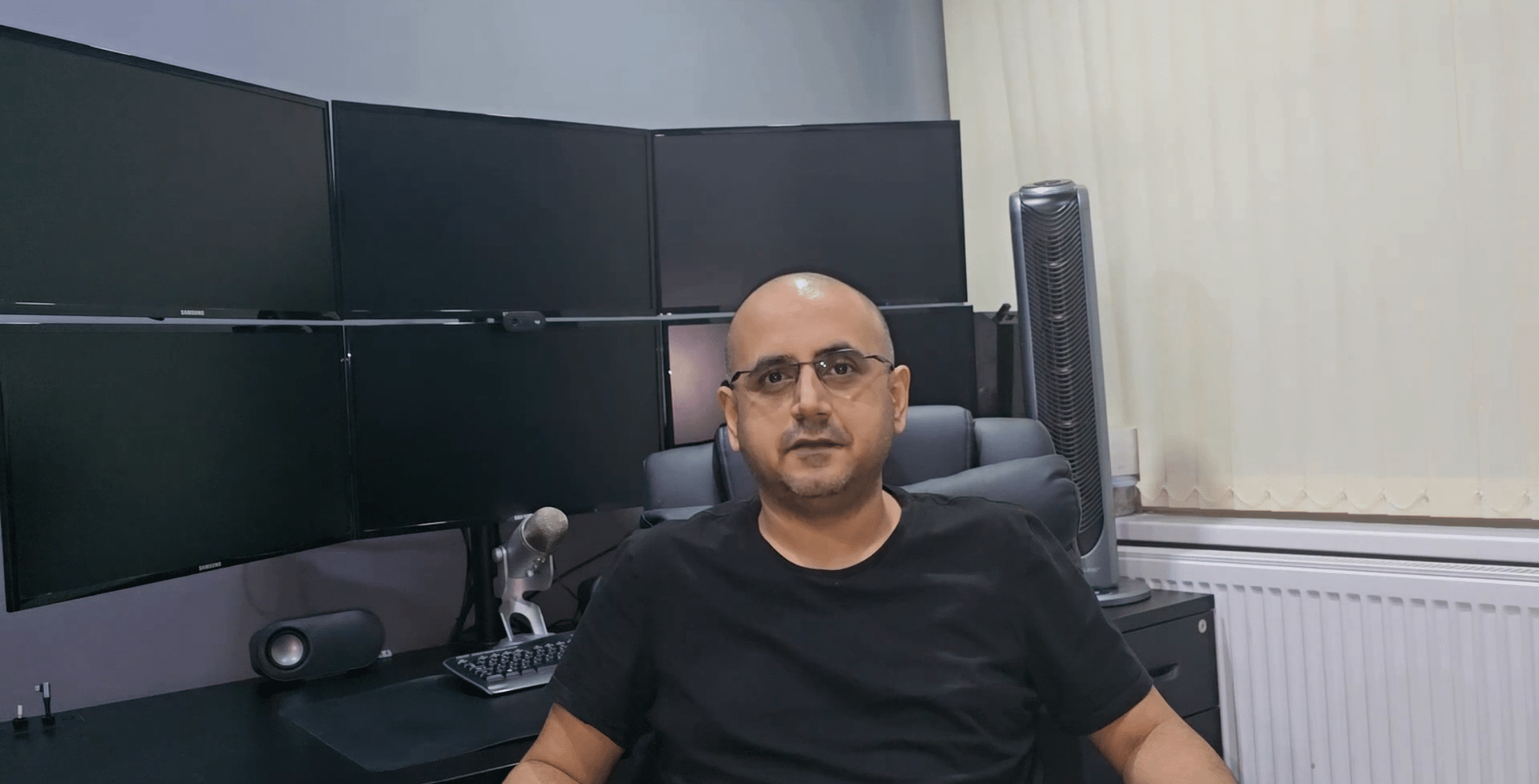

Personal Forex Mentor – Sachin Kotecha

This forex coaching programme is delivered directly by Sachin Kotecha, a CPD-certified educator with over 17 years of market experience. Mentoring sessions are structured, analytical, and education-first. The focus is applied professional development rather than prescriptive trading instruction.

Who This Forex Mentoring Is For

- Beginners seeking structured one-to-one forex training

- Intermediate traders refining analysis consistency

- Professionals building macro-technical integration skills

- Serious learners committed to disciplined development

Not suitable for: traders seeking guaranteed profits, signal services, or copy trading systems.

Certification & Recognition

Upon successful completion, you receive a CPD-accredited certificate in Applied Professional Forex Trading with Mentoring. This recognises structured professional development in macroeconomic analysis, technical frameworks, risk management, and trading psychology.

Frequently Asked Questions

What is Forex Mentoring?

Forex mentoring is a CPD-certified one-to-one forex coaching programme combining structured education with personalised analytical guidance.

Is this different from a forex course?

Yes. A forex course provides content. Forex mentoring adds personalised coaching and structured review.

Is this a trading signal service?

No. This is an education-first forex mentorship programme focused on independent competence.

Do I receive certification?

Yes. Successful completion awards a CPD UK-accredited certificate.

Can beginners join?

Yes. The programme adapts to beginner, intermediate, and advanced levels.

Curriculum

- 24 Sections

- 23 Lectures

- 1 Year Access

- 1. Introduction To The Mini MBAThis module sets the foundation for professional FX trading by outlining the full systematic process you’ll use throughout the programme. You’ll understand how macroeconomics, fundamentals, technicals, risk management and discipline integrate into a single repeatable workflow that underpins consistent performance.1

- 2. Understanding Currencies & Exchange RatesLearn how global currency systems evolved, how fixed and floating regimes work, and why FX markets behave the way they do. You’ll gain the structural knowledge required to understand volatility, competitiveness, and the forces driving exchange-rate movements.2

- 3. Identifying Tradeable OpportunitiesDiscover how professional traders filter the FX market for volatility, liquidity and macro-driven catalysts. This module teaches you to spot high-probability environments and avoid low-quality setups that waste time, capital and focus.2

- 4. Forex Market Infrastructure ExplainedA comprehensive breakdown of all market participants—central banks, corporations, hedge funds, banks, brokers and governments—and how their actions drive currency flows. You’ll understand who moves the market, why they act, and how their behaviour creates tradeable trends.2

- 5. Understanding Macroeconomic DriversA deep dive into the macro indicators that influence currencies: inflation, growth, labour markets, trade, fiscal policy and sentiment. You’ll learn why macro is the engine of FX and how data shapes long-term directional moves.2

- 6. Fundamental Macroeconomic AnalysisThis module teaches you how to translate macro data into bullish or bearish currency biases. You’ll build conviction through structured scoring and learn to generate fundamentally driven trade ideas based on real economic strength and weakness.2

- 7. Basic Chart AnalysisMaster the core building blocks of technical analysis: support, resistance, trendlines, moving averages, RSI, Fibonacci and market structure. You’ll learn how price reflects psychology and how to read charts with clarity and precision.2

- 8. Chart Platform TrainingGet fully proficient with TradingView, the professional charting platform used throughout the course. You’ll learn how to apply tools, annotate charts, manage watchlists, set alerts and build a clean, efficient technical workflow.2

- 9. Chart Pattern AnalysisExplore candlestick behaviour in depth, including reversal and continuation patterns such as engulfings, stars, hammers, tweezers, and gap formations. This module elevates your timing, accuracy and execution across all market conditions.2

- 10. Advance Technical AnalysisA full introduction to the Ichimoku system—one of the most powerful trend-analysis frameworks in trading. You’ll understand each component, how the cloud forms, and how to interpret long-term equilibrium and momentum.2

- 11. Advance Technical Analysis StrategiesLearn how to turn Ichimoku theory into actionable trading strategies. You’ll understand entry confirmation, crossovers, Kumo dynamics, multi-timeframe alignment and trend-following techniques used by institutional traders.2

- 12. Advance Technical Analysis Examples 1Apply advanced technical tools to real charts, combining price action, candlestick patterns and Ichimoku to build highly accurate technical narratives. This module strengthens your pattern recognition and execution discipline.2

- 13. Advance Technical Analysis Examples 2A continuation of live technical walkthroughs, showing how professional traders validate signals, filter out false breakouts, and synchronise multiple indicators for higher-probability setups.2

- 14. Advance Technical Analysis Examples 3Further real-market examples illustrating full technical confluence. This module reinforces how advanced techniques work together to generate reliable timing signals for both entries and exits.2

- 15. Trading Risk ManagementLearn the professional frameworks that protect capital and ensure long-term survivability. This includes position sizing, exposure management, volatility adaptation, correlation control, and portfolio-level risk governance.2

- 16. Correlated Forex Risk AnalysisUnderstand how currency correlations amplify or dilute portfolio risk. You’ll learn to avoid concentrated exposures, manage cross-pair relationships, and build portfolios that reflect professional-grade diversification.2

- 17. Trading PsychologyA complete exploration of trader mindsets, behavioural biases, fear, greed, FOMO, overconfidence and loss aversion. You’ll learn the mental frameworks that separate consistent traders from those who self-sabotage.2

- 18. Trading Plan & DisciplineBuild a structured trading plan covering strategy, risk rules, entries, exits, journalling and emotional management. You’ll learn to systemise your process, stay objective, and enforce discipline across all market environments.2

- 19. Common Trading Mistakes & Market WisdomA breakdown of the errors that destroy retail traders—over-trading, revenge trading, poor sizing, no stops, following the crowd—and how to eliminate them. The module delivers practical wisdom for long-term consistency.2

- 20. Putting It All Together Example 1A full start-to-finish demonstration of the complete trading process, combining macro scoring, fundamental analysis and technical execution to generate a professional-quality trade idea.2

- 21. Putting It All Together Example 2A second full walkthrough showing how to align economic data, currency strength, sentiment and chart analysis. You’ll see how the process adapts across different market conditions.2

- 22. Putting It All Together Example 3A final comprehensive example illustrating advanced decision-making, risk management, trade exits and scenario handling when fundamentals and technicals evolve over time.2

- 23. Final ExamYour final assessment covering macroeconomics, fundamentals, technicals, psychology, risk, and the full systematic process. Passing the exam confirms your mastery of the Mini MBA framework.1

- FeedbackA dedicated space for reflections, performance review and personalised guidance to strengthen your trading development and close skill gaps.1